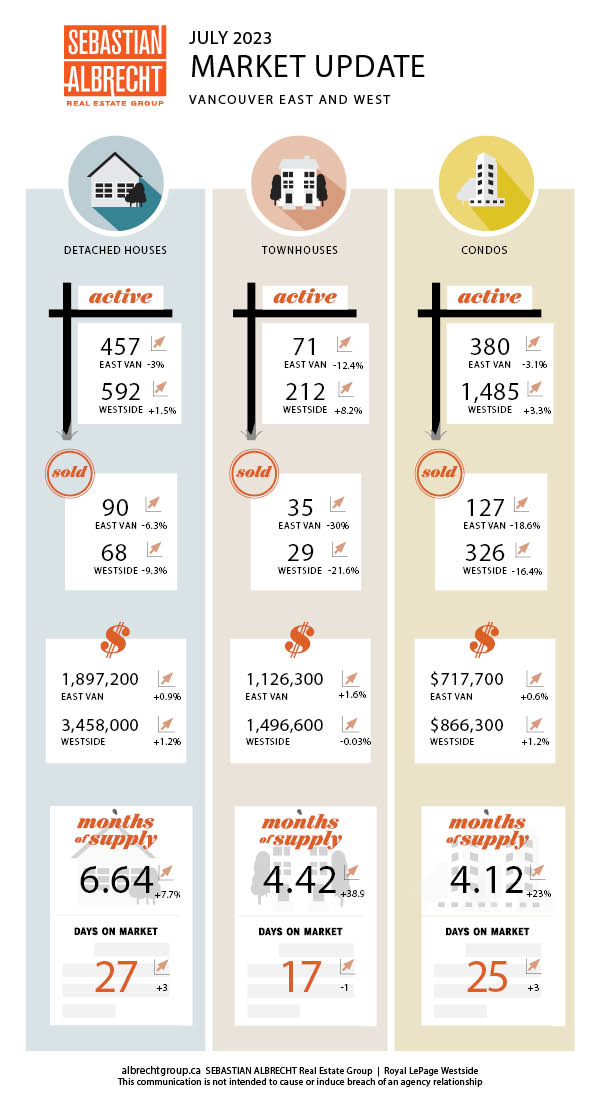

There were 723 sales in Vancouver in July 2023. This was an impressive 27% higher than the sales seen in July 2022...and could be otherwise pointed to as an indication of just how hot Vancouver's real estate has been lately.

That is, until you remember that last July was when the Bank of Canada raised interest rates by 1% and we saw a very quick slowdown in sales activity for the remainder of the year.

Looking more closely, we also see that sales were -15% from last month and also -16% from the 10-year average. By these measures, sales activity can clearly be seen to have cooled off from the torrid pace of the last few months.

New listings dropped to 1,525 which was -10.8% from last month but up +27% from a year ago and essentially flat when compared to the 10-year average (+0.4%). Total active listings rose to 3,403 but this was up just slightly over last month (+1.2%) and down (-12.6%) compared to last year.

We can see that generally all activity levels have tapered off to begin summer....