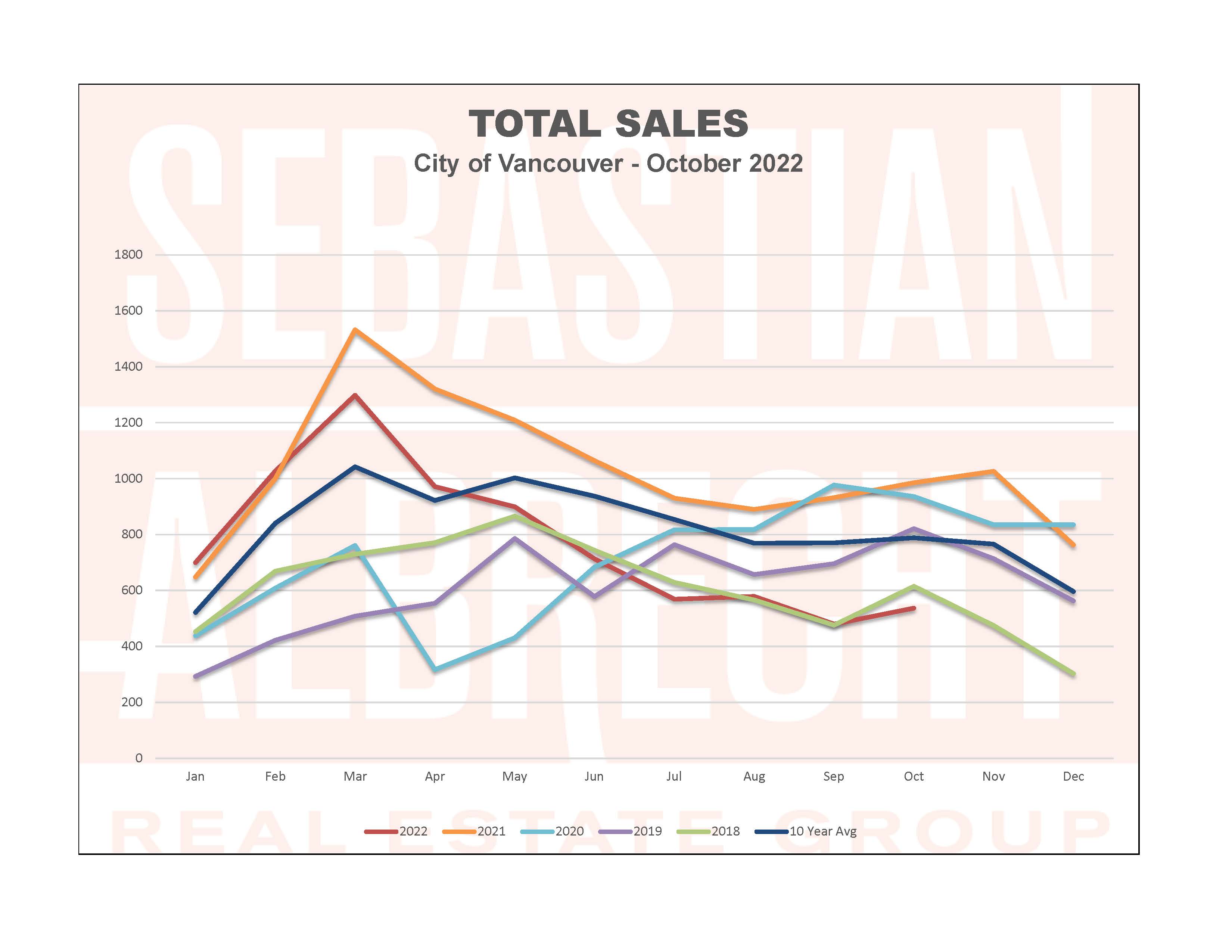

Sales were up (+11.9%) last month over the previous month, but down (-45.5%) from a year ago....and down a very significant -32% from the 10-year average.

We typically see a bump in sales in October over September, so I wouldn't read too much into the monthly increase. What's most significant is that big drop from the 10-year average...so demand clearly remains well below typical levels for this time of year.

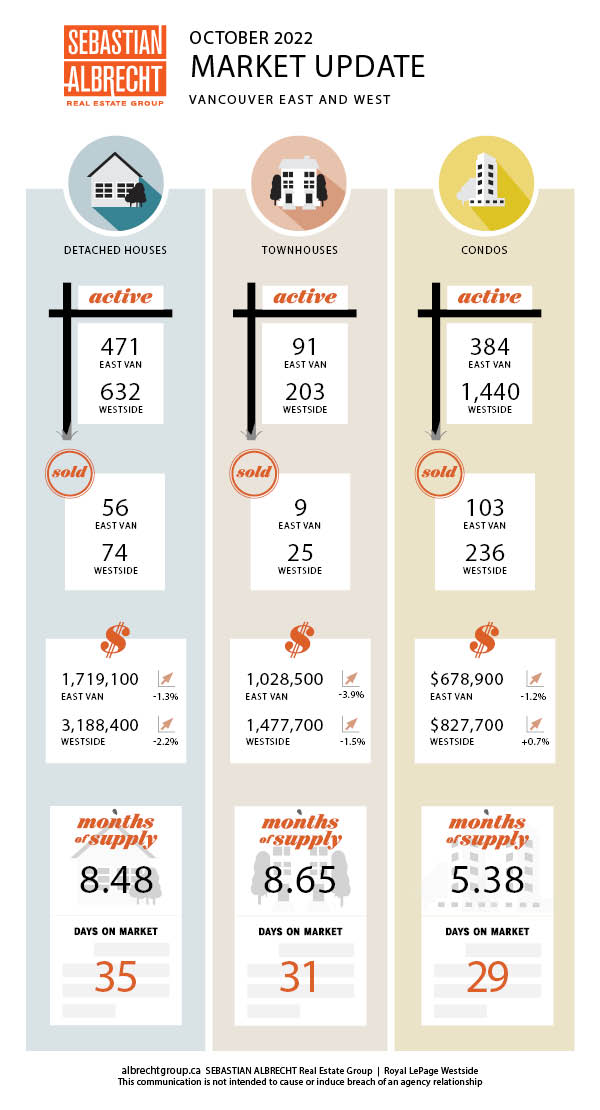

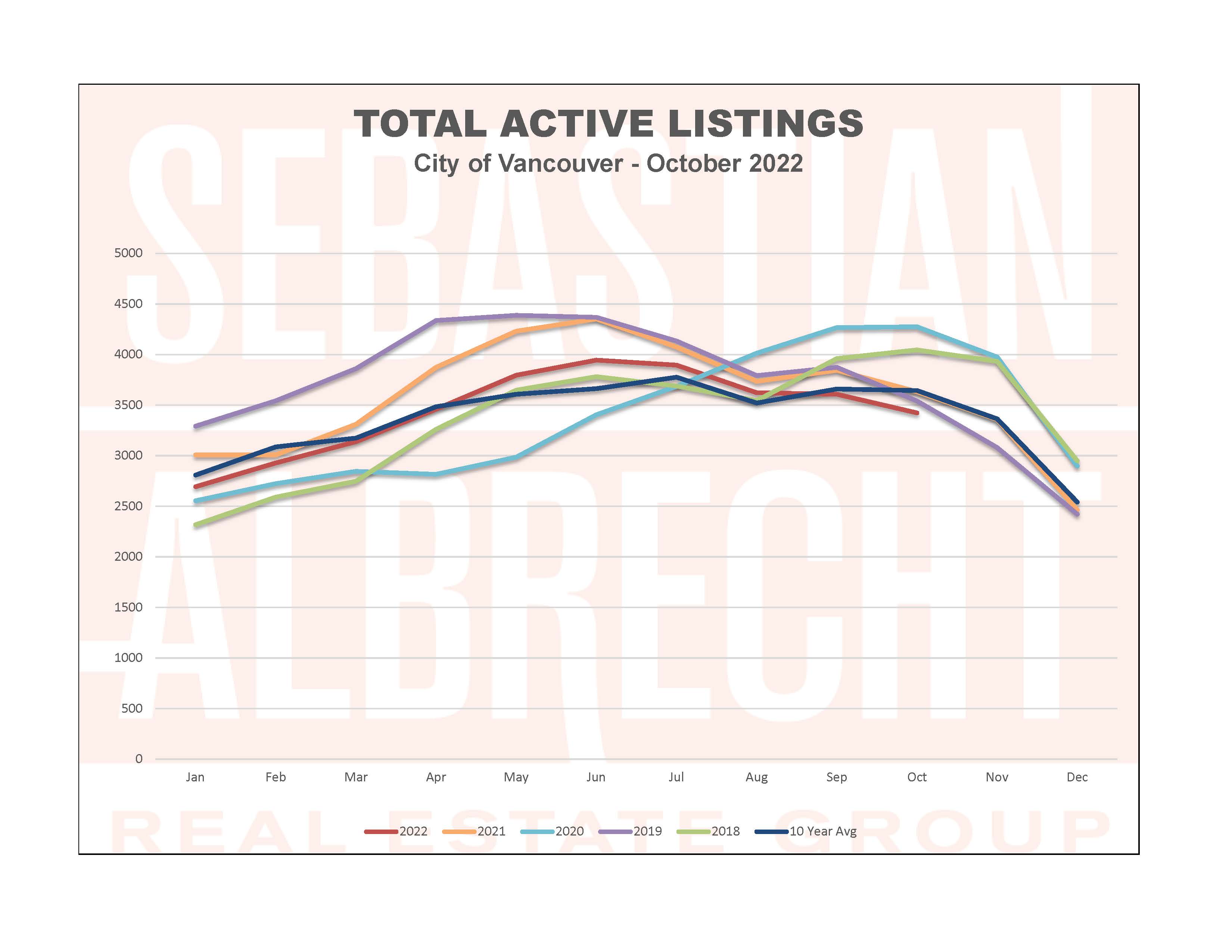

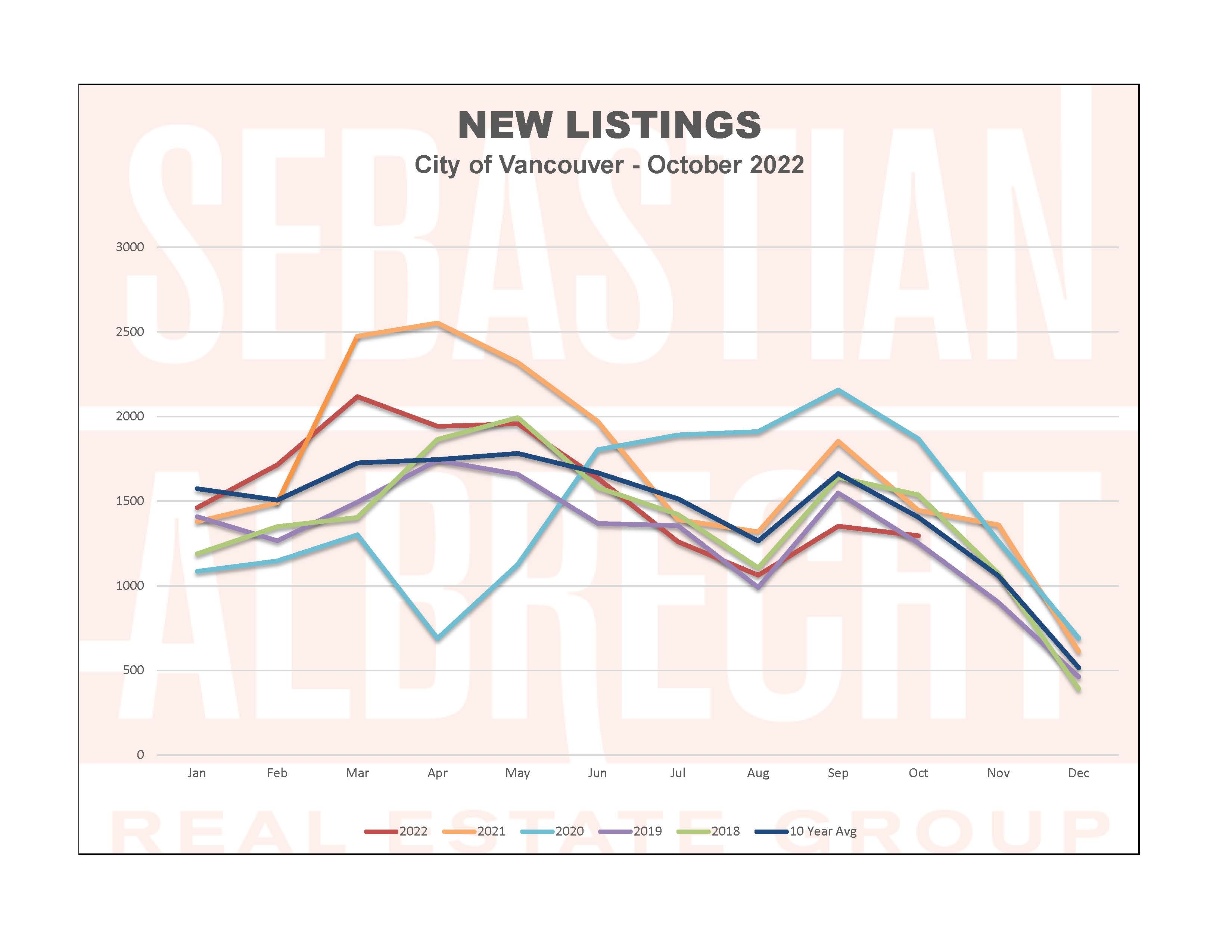

New Listings (-4.1% m-to-m) and Total Active Listings (-5.1% m-to-m) both edged lower from the previous month...and both are around 7% off the 10-year average.

These supply numbers indicate that supply is also shrinking. In fact, this is the fourth month in a row that we saw a decline in Total Active Listings (from a high of 3945 back in June). This is unusual at this time of year as the fall season usually sees a bumb in listing activity.

Combined, these numbers tell me that both buyers and sellers are hesitant to act in today's market. Economic headlines and rising interest rates are having their effect...but also, Vancouver property owners are not panicking and heading for the exits.

It seems clear that most owners understand that today's market is not indicative of a collapse. They are not heading to the exits, desperate to unload their investments. Rather, it's a healthy adjustment and a normal part of a market cycle.

But, that's also leading to some degree of frustration from buyers (a familiar theme in our real estate market over the last few years). While deals and opportunity exist, motivated buyers are not finding firesales or an abundance of options.

Comments:

Post Your Comment: