If you haven't been in a sensory deprivation tank for the last few months, you probably have some idea of how slow Vancouver's real estate market has become.

...increasing economic uncertainty and rising interest rates are at the very root of that decrease in activity. It's a significant change of pace from the last couple of years, but it's important to put it into perspective.

Thankfully, our market cannot be explosive ALL the time. It needs to pause, rest and refresh before taking another leg up.

That's what's happening right now...and it offers an opportunity for a new generation of buyers to step into the market.

So...let's take a closer look at these numbers, shall we?

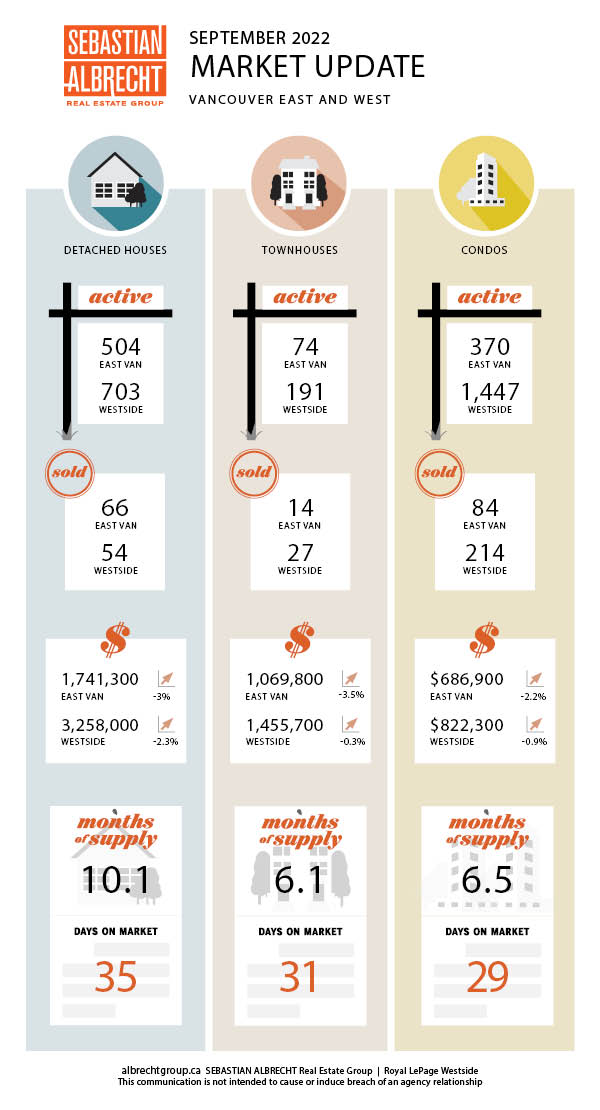

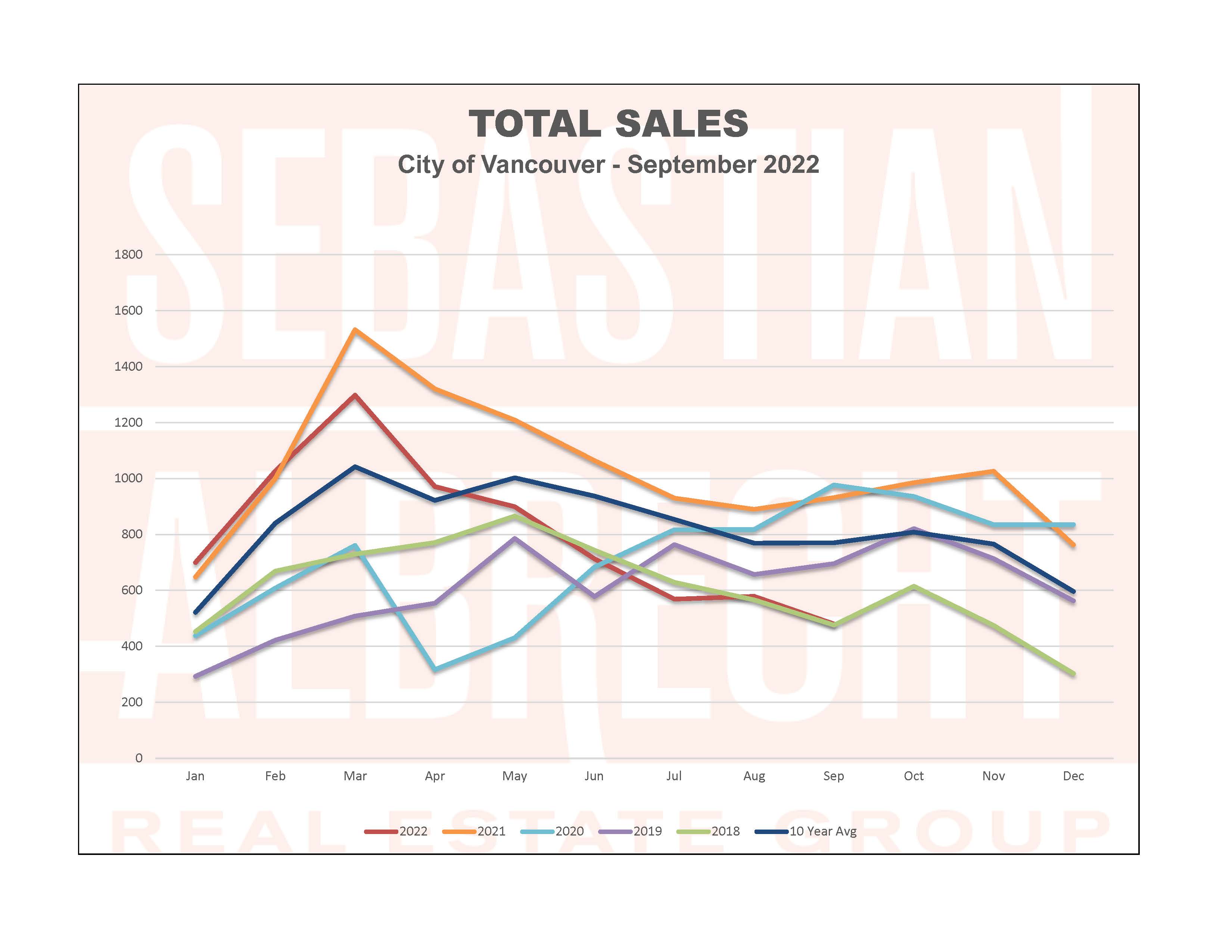

Sales fell to 480 (from 579). That's a drop of -17% from last month and 49% from a year ago. It's also -28.7% below the 10-year average (trending up from last month in relation to this average).

While demand declined, supply rose. It's an overall marginal increase in supply and it makes sense based on the time of year (we usually see a bump in listings in the fall).

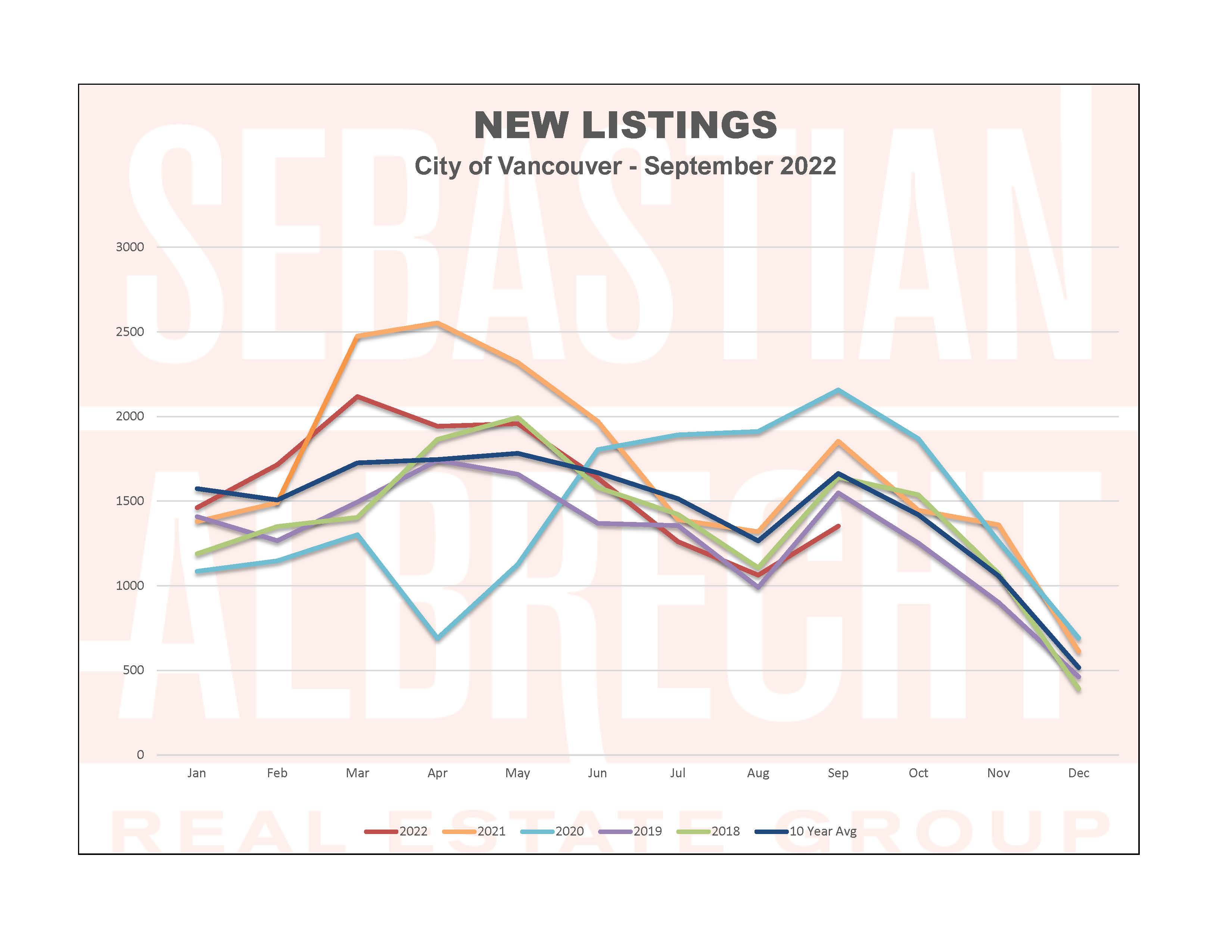

New Listings went from 1,063 to 1,352. That's a 23.8% increase from the previous month but a decline of -26.6% from a year ago. In relation to the 10-year average it's an -18.8% decrease.

Total Active Listings fell to 3,484 from 3,549. That's a decline of -1.8% from the previous month and down -9.4% from a year ago. Compared to the 10-year average it's basically flat with a decline of just -0.02%.

It appears that rising interest rates have significantly impacted our market. Both demand and supply are muted...and this is likely to continue through the fall...giving an opportunity for astute buyers and investors to secure Vancouver property.

...increasing economic uncertainty and rising interest rates are at the very root of that decrease in activity. It's a significant change of pace from the last couple of years, but it's important to put it into perspective.

Thankfully, our market cannot be explosive ALL the time. It needs to pause, rest and refresh before taking another leg up.

That's what's happening right now...and it offers an opportunity for a new generation of buyers to step into the market.

So...let's take a closer look at these numbers, shall we?

Sales fell to 480 (from 579). That's a drop of -17% from last month and 49% from a year ago. It's also -28.7% below the 10-year average (trending up from last month in relation to this average).

While demand declined, supply rose. It's an overall marginal increase in supply and it makes sense based on the time of year (we usually see a bump in listings in the fall).

New Listings went from 1,063 to 1,352. That's a 23.8% increase from the previous month but a decline of -26.6% from a year ago. In relation to the 10-year average it's an -18.8% decrease.

Total Active Listings fell to 3,484 from 3,549. That's a decline of -1.8% from the previous month and down -9.4% from a year ago. Compared to the 10-year average it's basically flat with a decline of just -0.02%.

It appears that rising interest rates have significantly impacted our market. Both demand and supply are muted...and this is likely to continue through the fall...giving an opportunity for astute buyers and investors to secure Vancouver property.

Comments:

Post Your Comment: