November is historically a quieter month in terms of real estate market activity. As we approach the holidays sales and listings cool off...and this year is no exception.

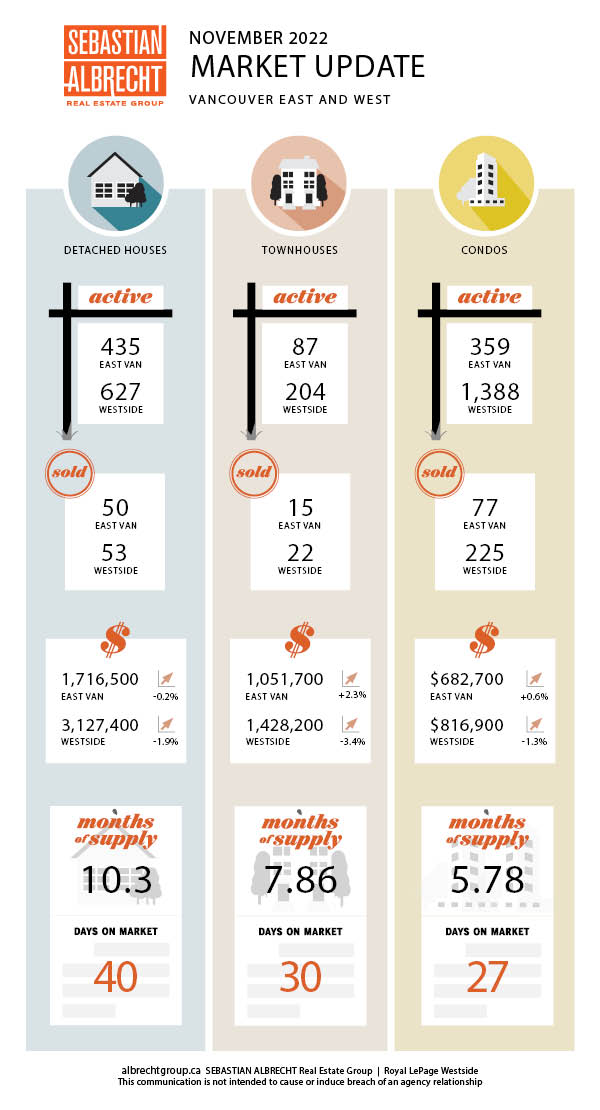

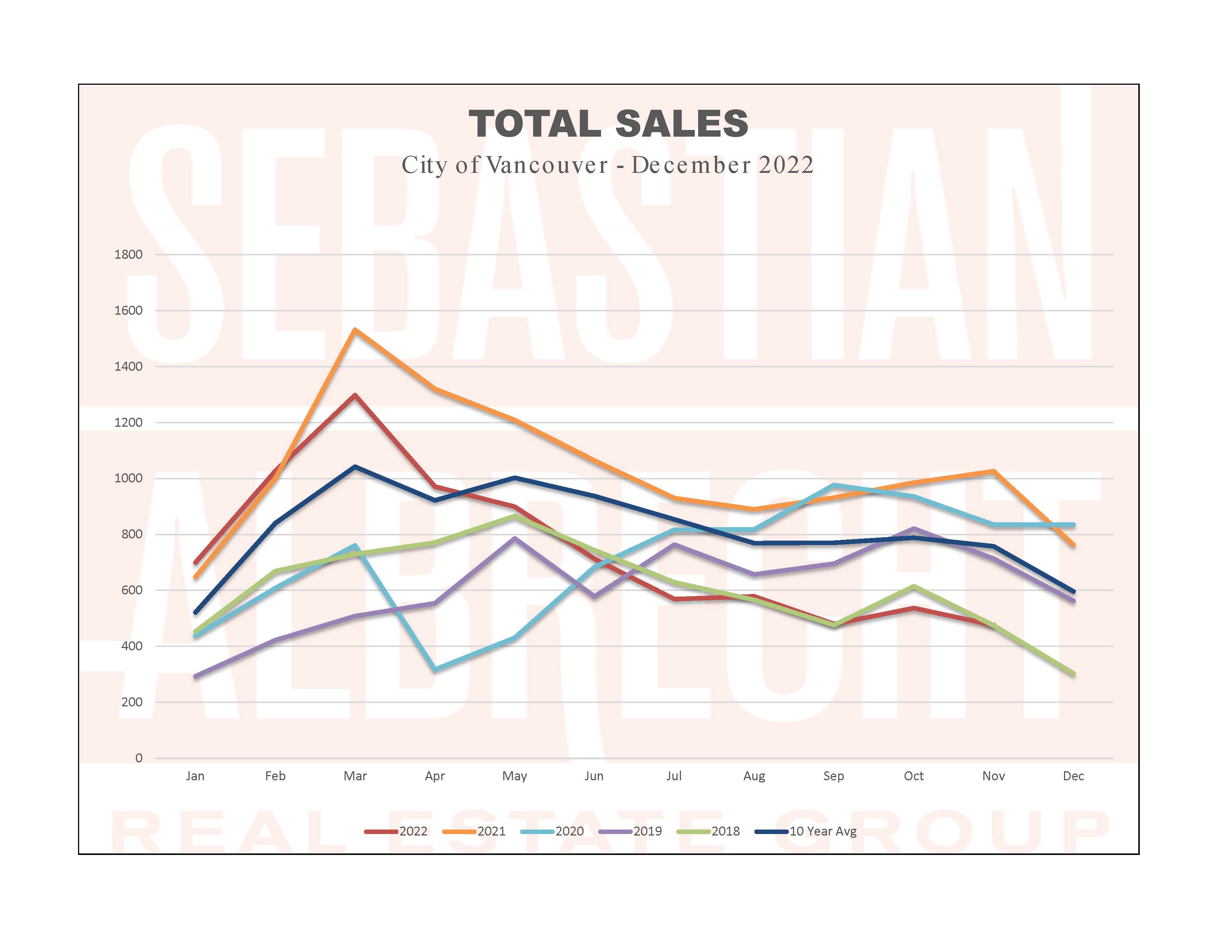

Vancouver home sales dropped -11.4% from the previous month and a whopping -53.6% from a year ago. The 476 were also -37.2% below the 10-year average.

Obviously, this was not just a typically quiet November. It's the inflationary backdrop that is giving real estate buyers pause in recent months. As inflation continues to increase, the Bank of Canada has made clear so will interest rates.

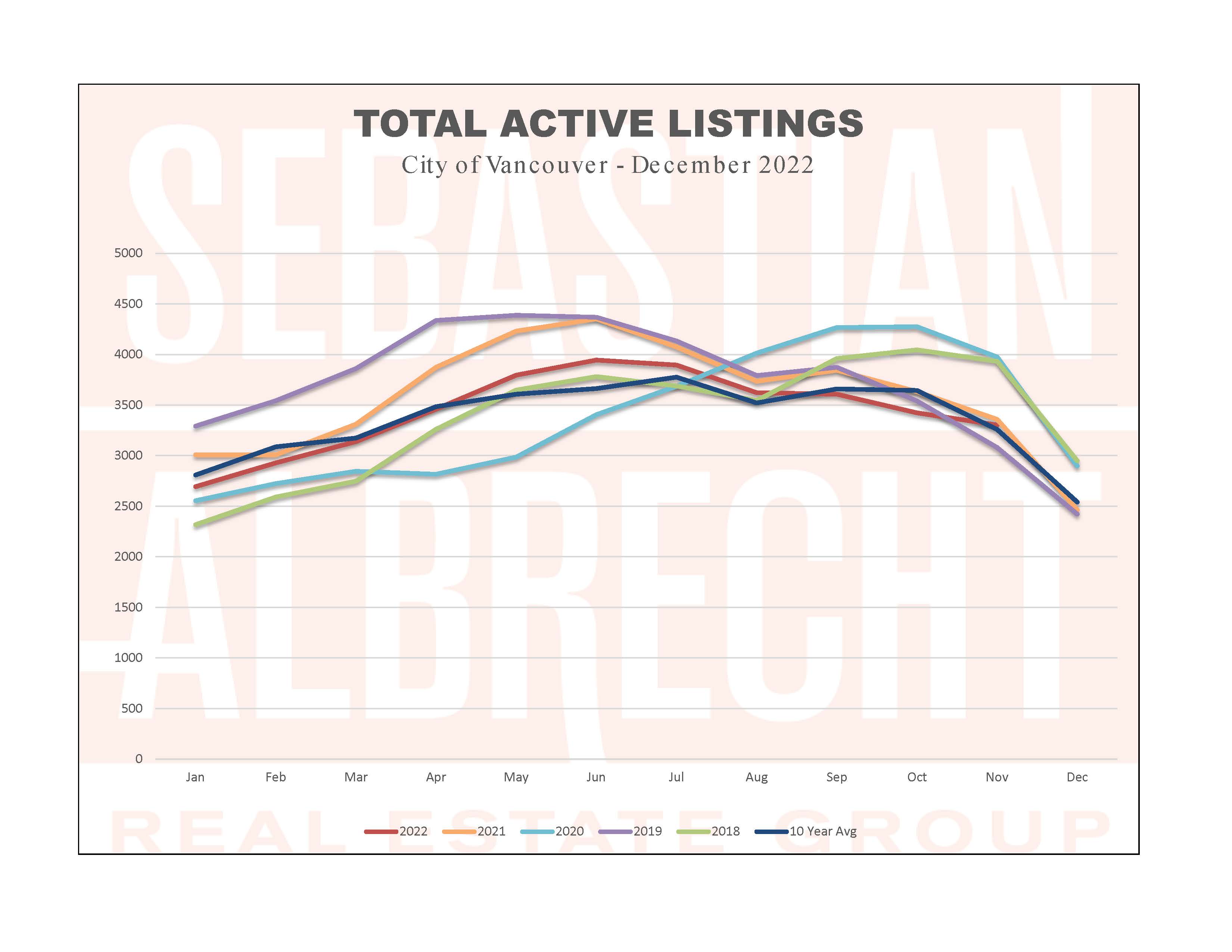

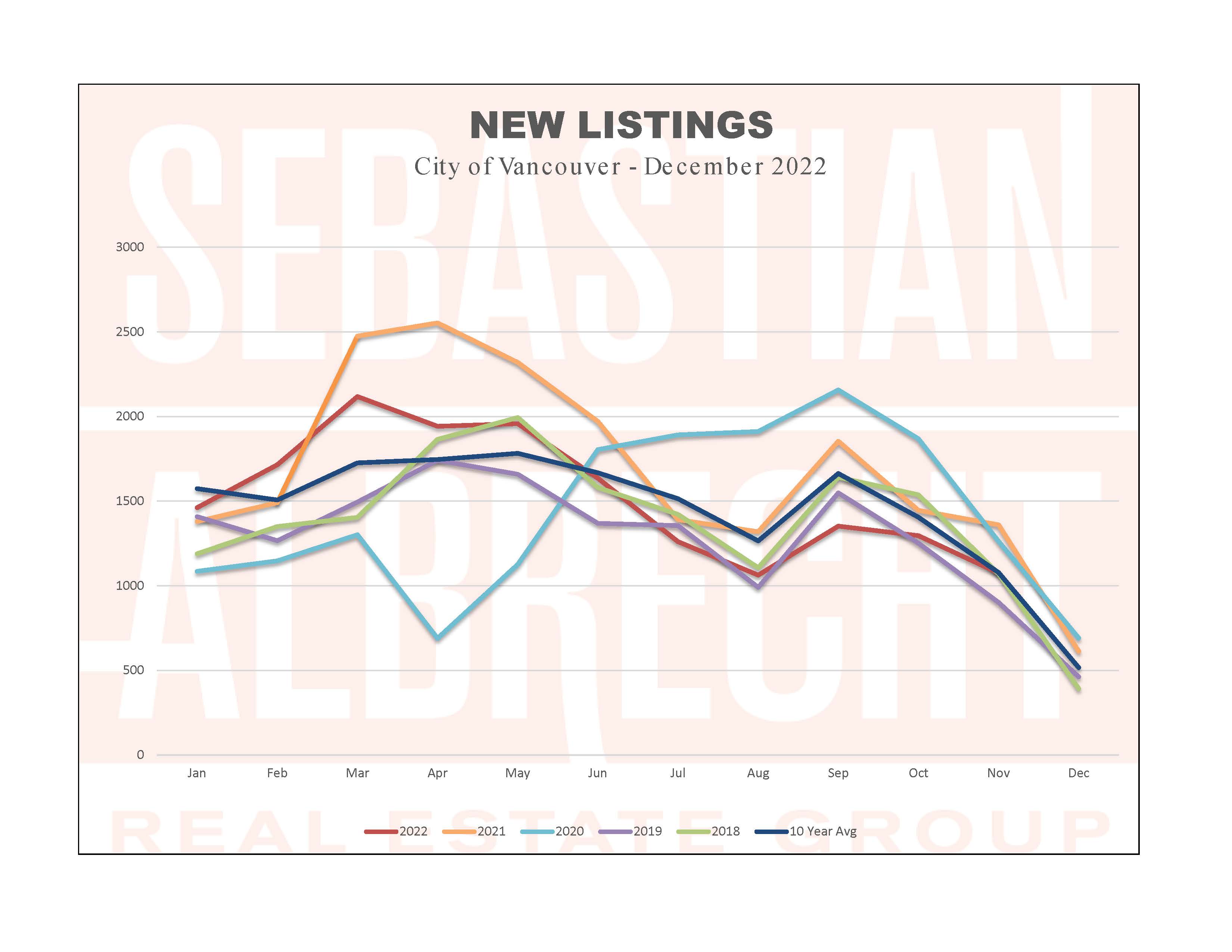

That action continues to most significantly impact the demand for real estate (and thus sales). And while demand has been stifled so has (to a lesser extent) supply.

New listings (1,076) were -17% from the previous month and -20.9% from a year ago. Total active listings (3303) were down -6.1% from October and -1.7% from last year. Both of these supply side metrics were essentially on par with their 10-year averages.

Meanhwile, prices are being affected by the drop in demand over the last few months. Only condo prices are still above what they were a year ago (+1.1%)...and only the lower end of the cost spectrum (specifically for townhouses and condos) remains robust price-wise.

The weakest part of the market continues to be luxury real estate as well as detached homes. This is true especially on the westside of Vancouver where houses are now down nearly -7% from a year ago (and just 2% on the Eastside).

At their most recent meeting the BOC indicated they may be taking their foot off the interest rate lever. With continued in-migration, I can see a not too distant future where prices (especially for "affordable" homes) will very quickly ramp up once again...but it all depends on where inflation heads from here (and how the Bank of Canada reacts to it).

Comments:

Post Your Comment: