2022 ended with a whimper. At least, in terms of the Vancouver real estate market.

After a torrid surge in market activity through the COVID lockdown, it fell off significantly over the last year. This was brought about primarily by the Bank of Canada trying to get inflation under control by rapidly hiking the policy rate.

These higher interest rates are clearly having a big impact on both buyers and sellers of Vancouver real estate.

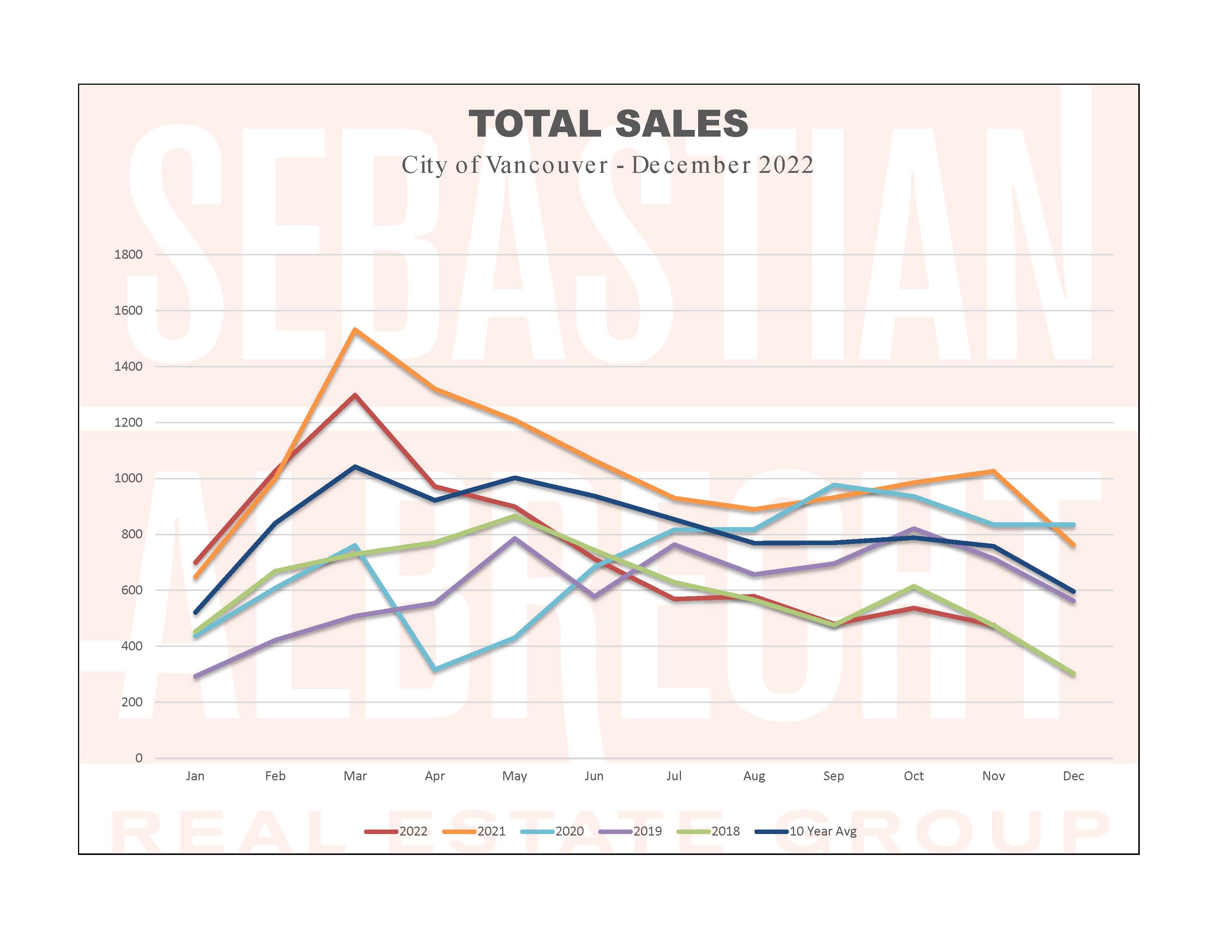

Sales fell to 246 which was -20.1% month-to-month and -47.4% year-to-year. This was also well below the 10-year average (-34.2%).

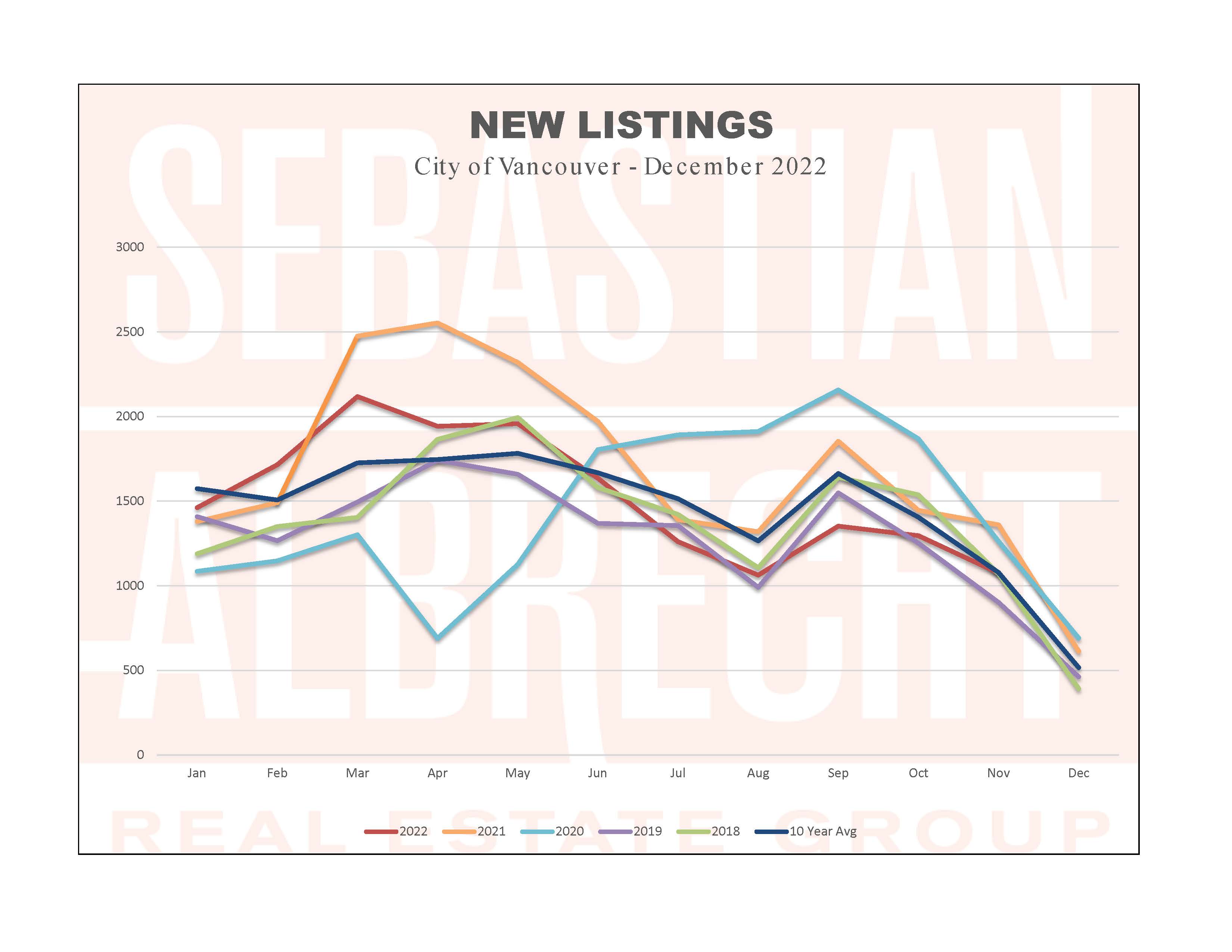

New Listings also dropped to 246 which was -67% from last month and -38% from a year ago. It was also -17.8% from the 10-year average.

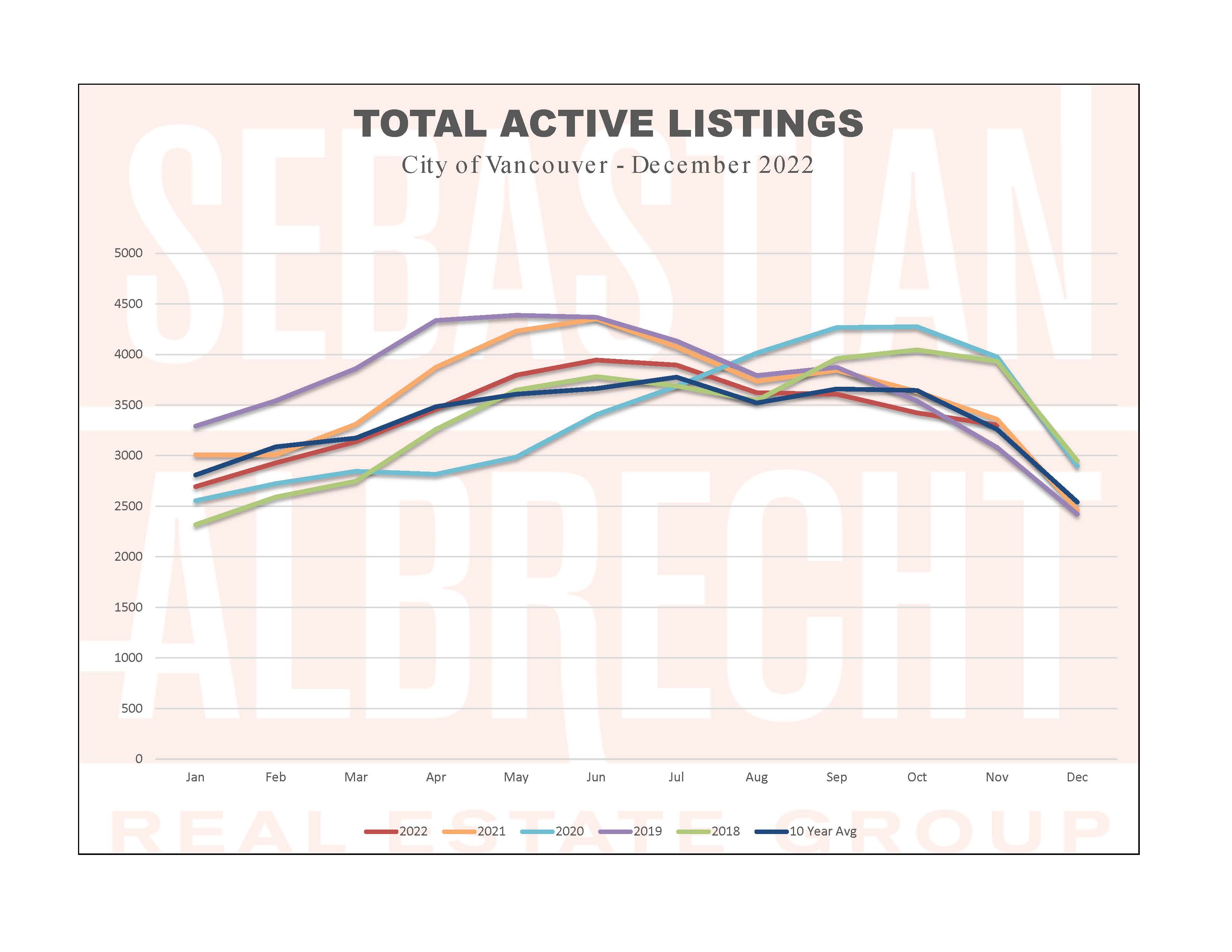

Total Active Listings reached 2423 or -26.5% from the previous month and only -1.7% from a year ago. This was +10.4% vs the 10-year average.

In the meantime we are seeing the decrease in demand of the last year impacting prices. Every property type in Vancouver fell last month...from East Van condos which were down just -0.9% to the biggest decline in Westside townhouses at -5.8%.

And so, what's in store for 2023?

Most economists believe that the Bank of Canada is very close to ending their cycle of interest rate hikes (if they haven't already)...but it appears that our current level of interest rates may be around longer than originally expected.

We'll need to watch the market very closely to see how the new reality impacts both Vancouver buyers and sellers. I suspect that we will see a cautious market in the coming months with below-average levels of activity.

After a torrid surge in market activity through the COVID lockdown, it fell off significantly over the last year. This was brought about primarily by the Bank of Canada trying to get inflation under control by rapidly hiking the policy rate.

These higher interest rates are clearly having a big impact on both buyers and sellers of Vancouver real estate.

Sales fell to 246 which was -20.1% month-to-month and -47.4% year-to-year. This was also well below the 10-year average (-34.2%).

New Listings also dropped to 246 which was -67% from last month and -38% from a year ago. It was also -17.8% from the 10-year average.

Total Active Listings reached 2423 or -26.5% from the previous month and only -1.7% from a year ago. This was +10.4% vs the 10-year average.

In the meantime we are seeing the decrease in demand of the last year impacting prices. Every property type in Vancouver fell last month...from East Van condos which were down just -0.9% to the biggest decline in Westside townhouses at -5.8%.

And so, what's in store for 2023?

Most economists believe that the Bank of Canada is very close to ending their cycle of interest rate hikes (if they haven't already)...but it appears that our current level of interest rates may be around longer than originally expected.

We'll need to watch the market very closely to see how the new reality impacts both Vancouver buyers and sellers. I suspect that we will see a cautious market in the coming months with below-average levels of activity.

Comments:

Post Your Comment: