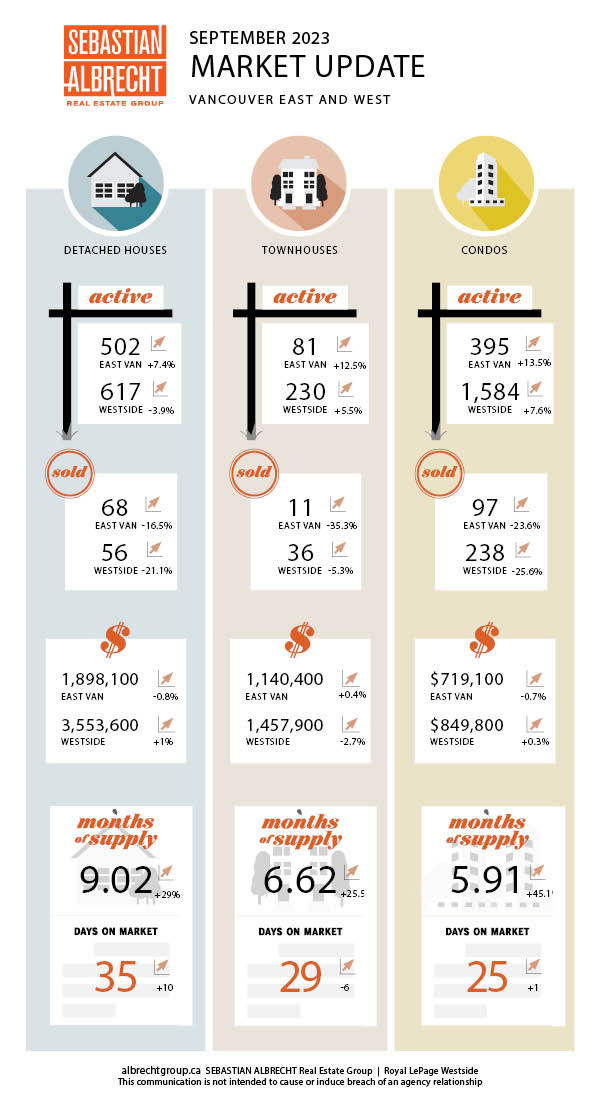

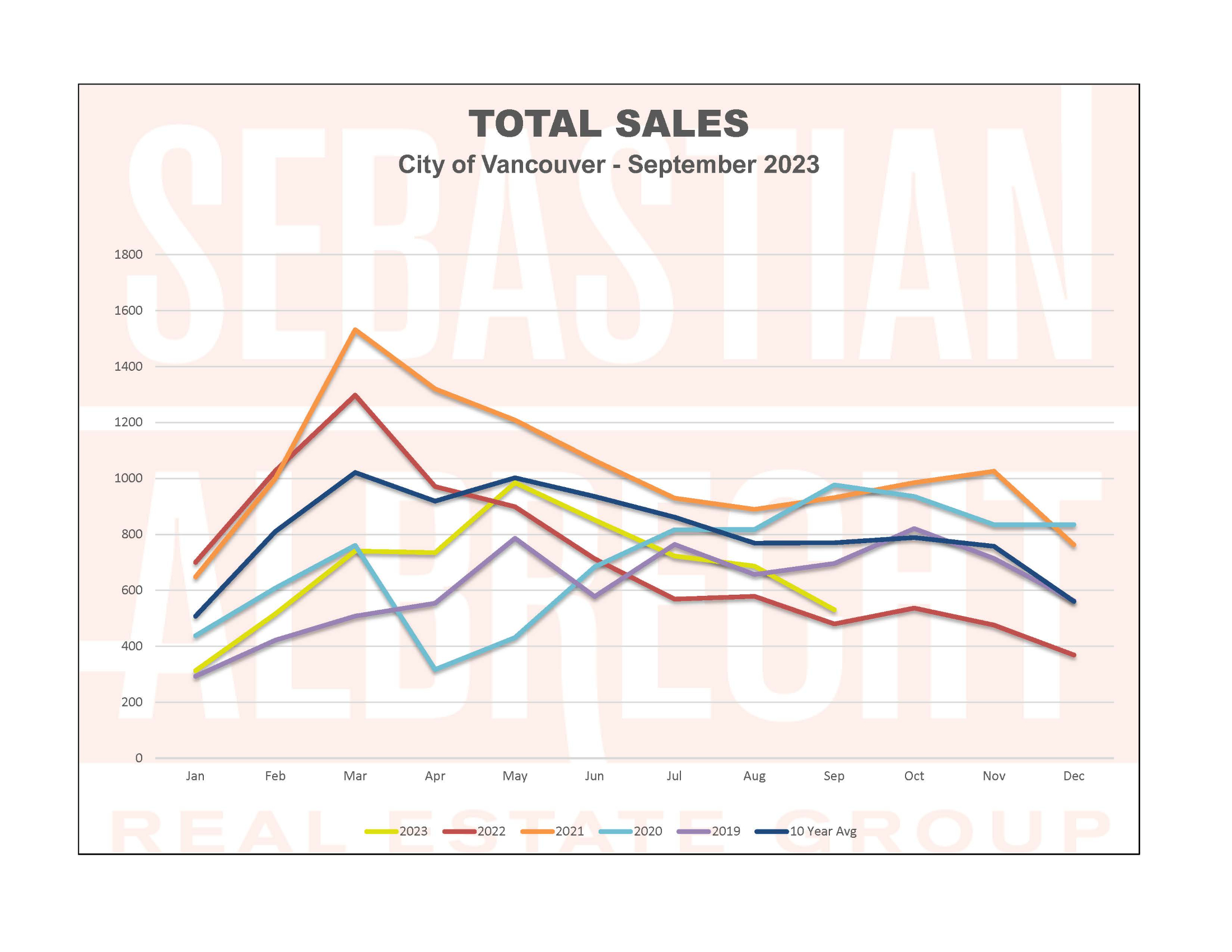

We had 531 sales in Vancouver in September 2023. This was -22.7% from August but up +10.6% from a year ago. It was also down a resounding -31% from the 10-year average...continuing a trend that started back in July of this year.

It was back in July, just after the first "surprise" interest rate hike were we first started to see demand falter after a very strong first half of 2023. This is now 3 months in a row that we've had successive declines on the demand side of housing in Vancouver.

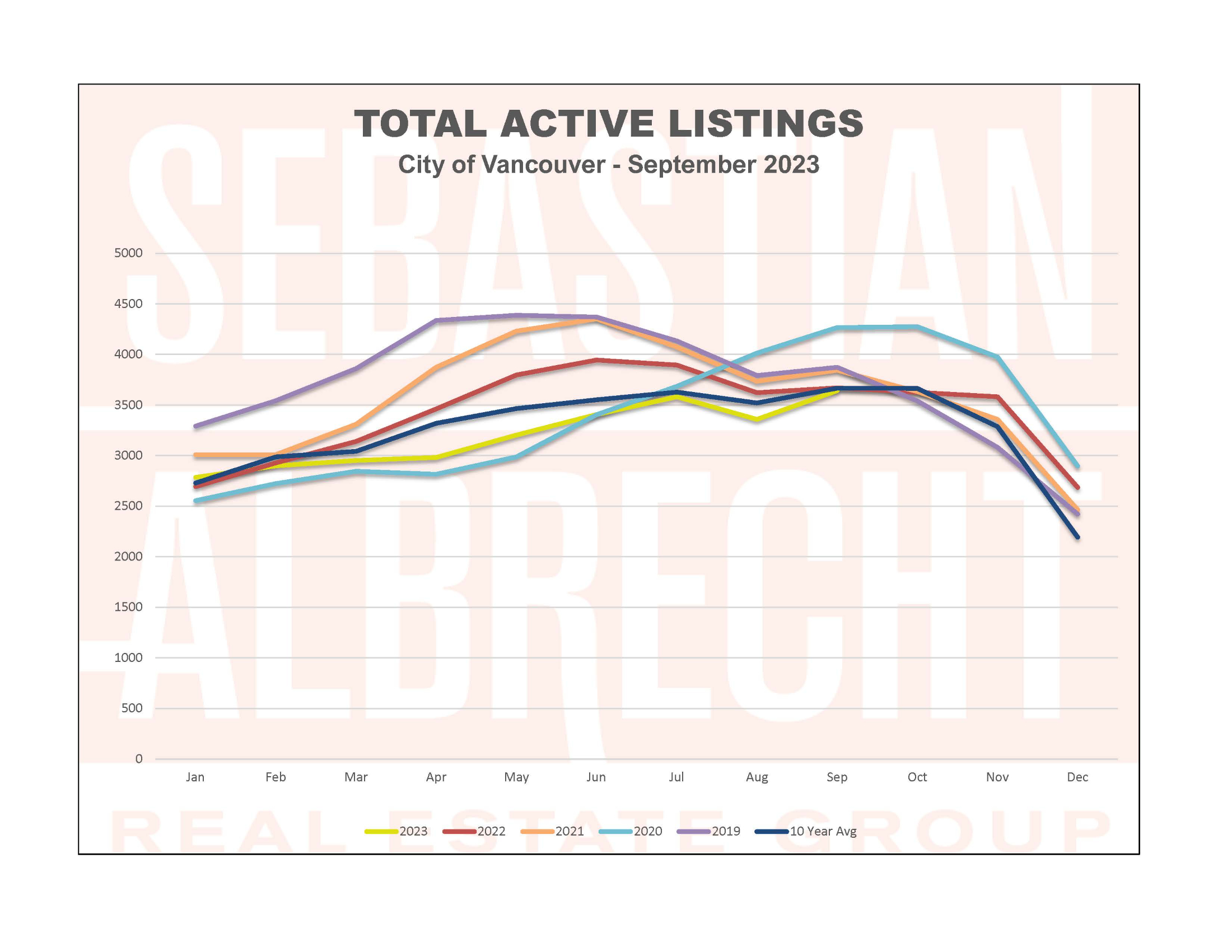

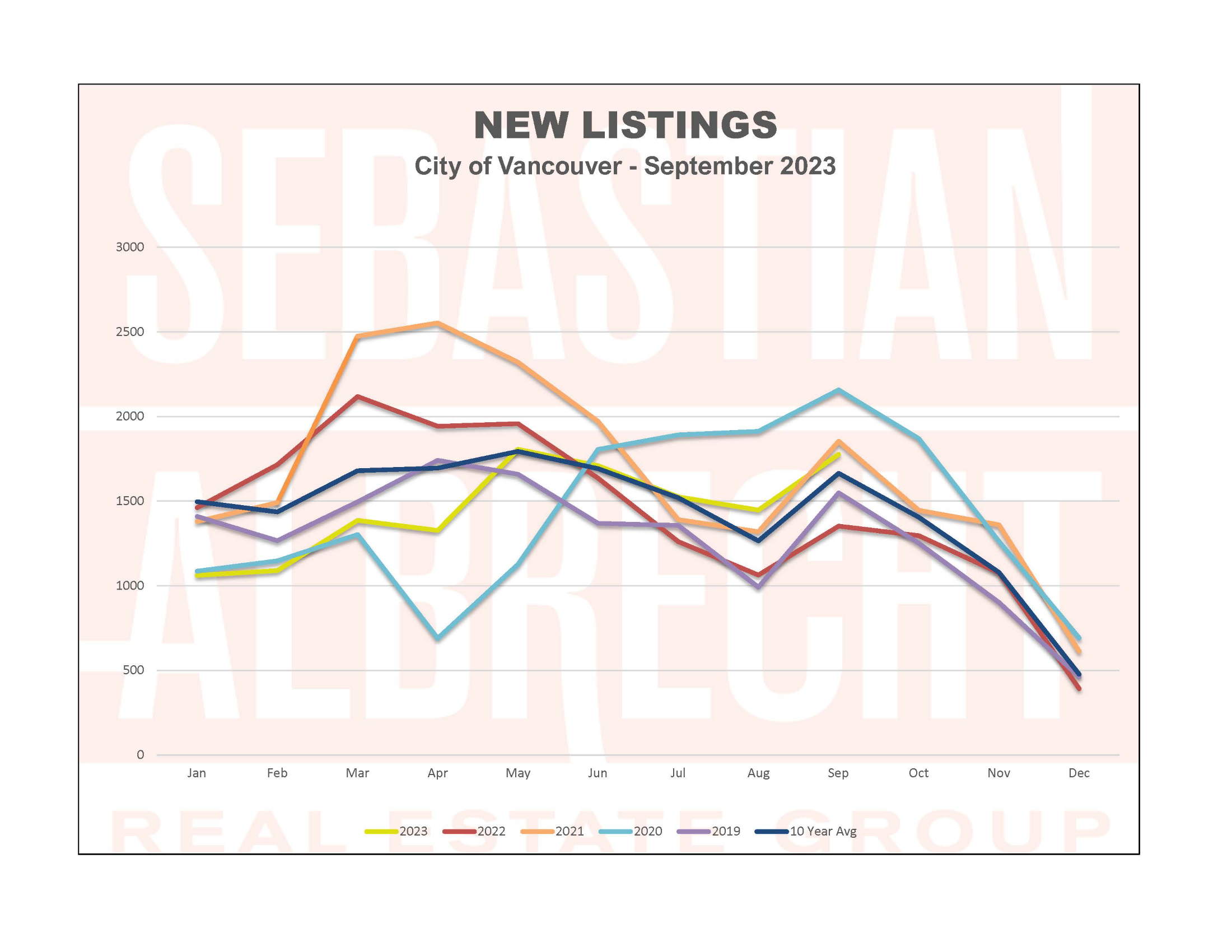

Meanwhile, supply has been growing.

There were 1,777 new listings (+22.8 m-to-m and +31.4% y-to-y) along with 3,642 total active listings. Total listings were up +8.4% from the previous month but importantly remain right around the 10-year average (-0.7%).

So supply has steadily increased through the year, but not to unusual levels. But with supply increasing and a pullback in demand we are seeing pressure on prices finally easing up.

Most housing types across the city were either flat or down slightly. The biggest increase was for westside house at $3,553,600 (+0.98%) while the biggest drop was for westside townhouses at $1,457,900 (-2.7%).

Early in the summer I wrote that we'd need to see if early signs of the market coming off it's hot pace were due to a typical seasonal adjustment, or due to interest rates. It appears that it's becoming clear that inflation and increasing interest rates are finally having an impact on the Vancouver real estate market.

I don't expect that this impact will last long. If history is any guide, these slower periods in our market tend to reverse very quickly...but of course, time will tell.

As always, let me know if you have any questions or if you'd like some insights on how the current market environnment might impact your plans.

Comments:

Post Your Comment: