The big headline this past month is that the market appears to be back.

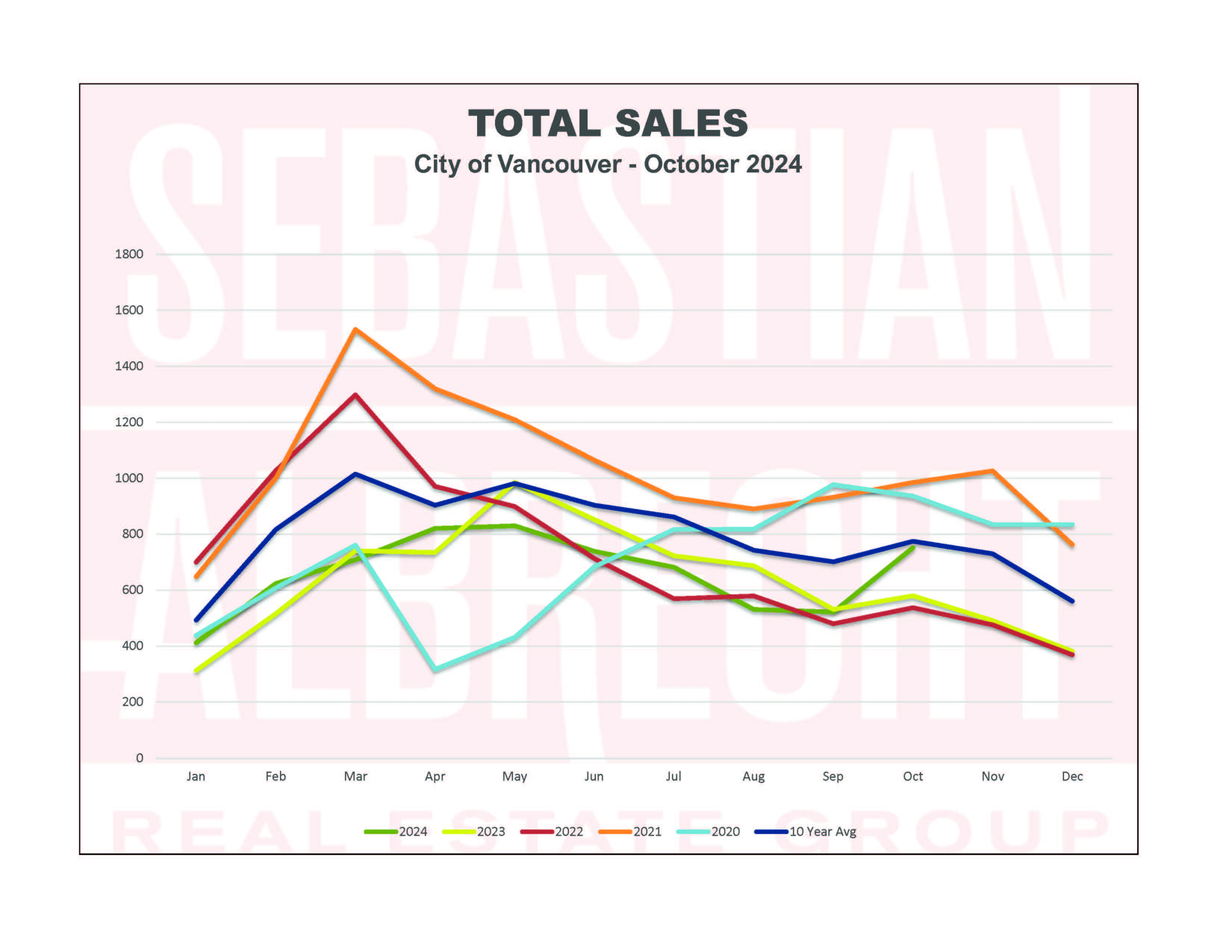

Sales popped rising +44% over the previous month to 752 in October (and +30% from a year ago). This was rather unexpected...as our market has seen demand stagnate for what seems like forever. While we've had a couple of months here and there were Sales surged a bit, it was never this dramatic. And, if anything, demand had really slid in the last few months of the summer and into the fall (just as the first two interest rate cuts hit).

At this point, Sales are just -3% below the 10-yr average...and I think that's an important point. It means that current demand levels (or at least in October) were right about average. That surge just brought us back to where we SHOULD be. It just looks hot in comparison to how slow demand has been in the last year or so.

But what about the rest of the market?

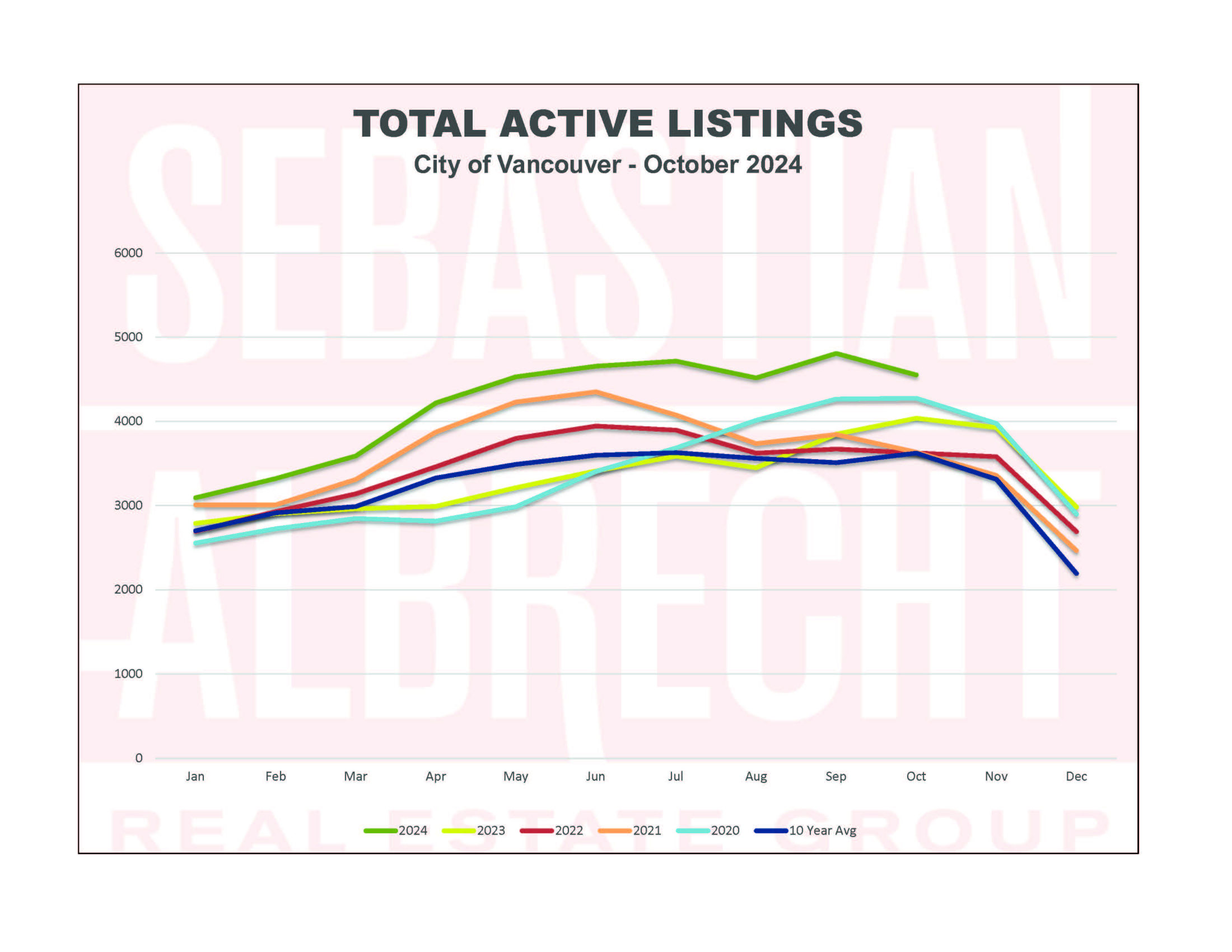

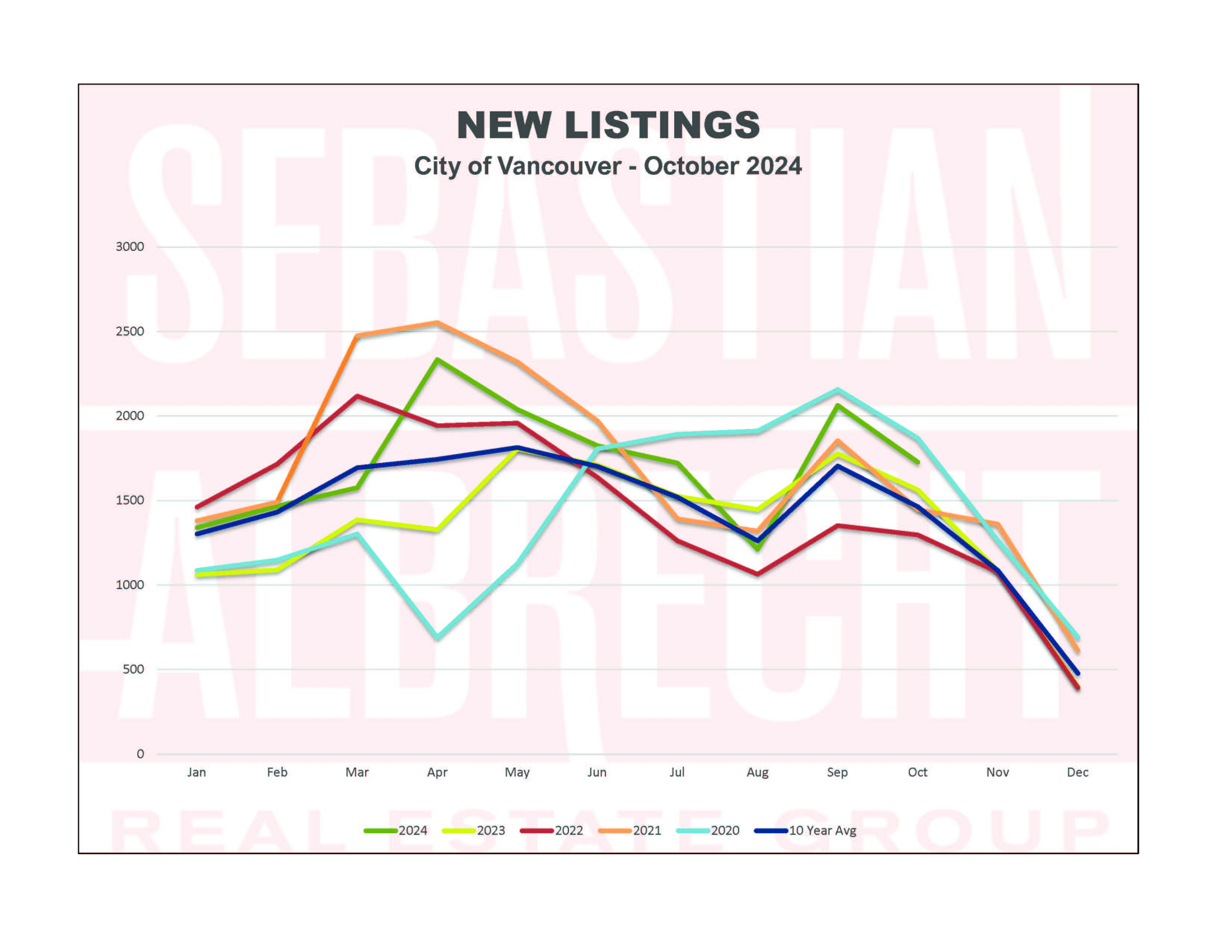

Well, New Listings dropped to 1,727. Down (-16%) from September but about +11% from a year ago and still above (+18%) the ten year average. Meanwhile, Total Active Listings fell off the recent record reached in September. Falling -5% to 4,552 (but up +3% from a year ago). I had to go all the way back to the summer of 2012 to find a month with as high a listing count as we had in September...and we are still well above the 10-year average (+26%).

And while supply numbers are high, I think it's important to point out buyers are still having a hard time finding the homes they want. A couple of reasons for this, I think;

1) There's a lot of supply in our market that is slated for "land assemblies". This type of property takes a long time to sell...and certainly isn't selling in the current market so it swells listing numbers (to an extent).

2) Many seller's are listing properties at aspirational prices. They'd like to move on, but only if they get the price that they are willing to accept. These are often numbers above what the market is currently willing to bear...keeping these listings on the market longer and swelling listing numbers.

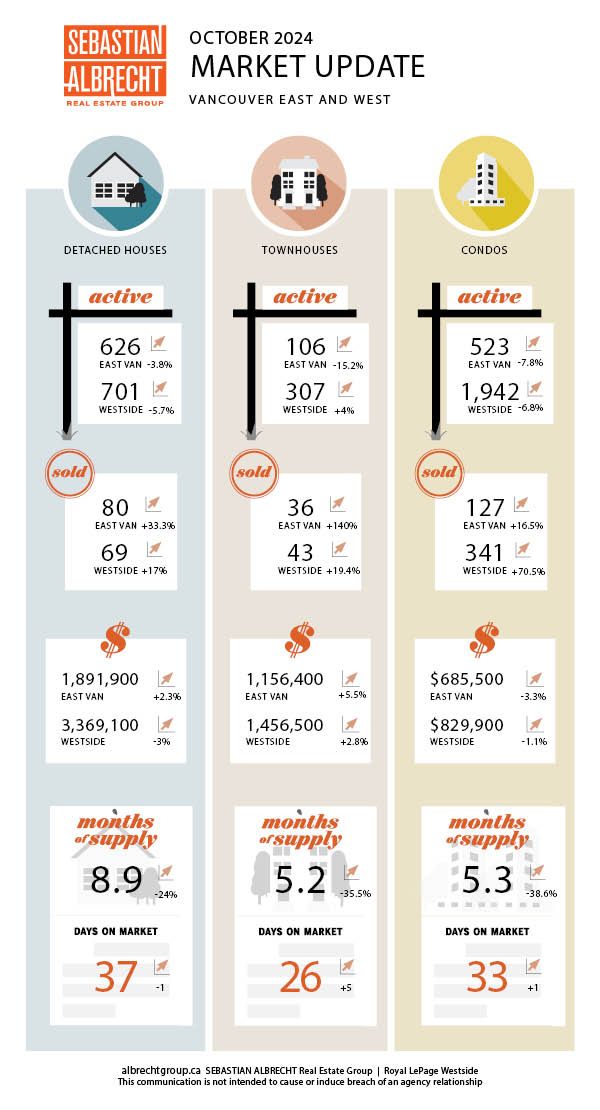

The market has become increasingly complex. Different property types in different areas are being impacted in a variety of ways. What I've found is that outlying areas of our market aren't faring as well as the inner parts of the city. Higher-end homes are also lagging a bit right now (westside houses for example were down nearly 3% in value in the last month alone).

There seems to be more activity at "affordable" price points as both first-time buyers and investors are starting to become more active again. These are segments of our market that have been very quiet for a long time...and often indicate a turn in the market is occurring.

There's definitely a shift in market sentiment in the last few weeks. I'm getting a lot more active buyers who are starting to feel that there's an opportunity in our market as interest rates decline...and I don't disagree with them.

Comments:

Post Your Comment: