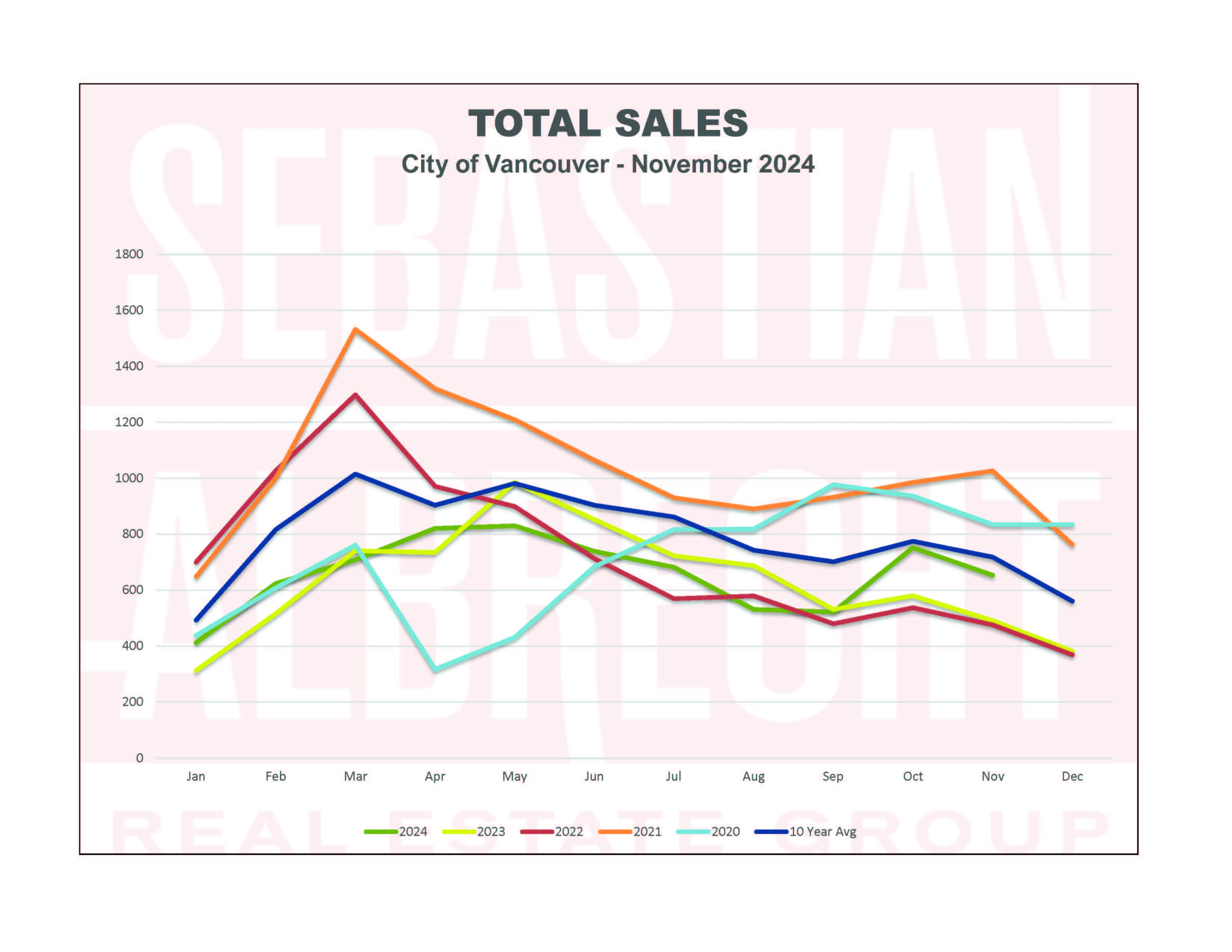

After demand jumped in October, November didn't continue that trend.

Sales fell month-to-month (-13.2%) but rose (+33%) compared to a year ago. More significantly, the number of sales last month was -9% below the 10-year average....continuing our trend this year of below-average demand, but starting to see that demand consilidate now towards the end of the year.

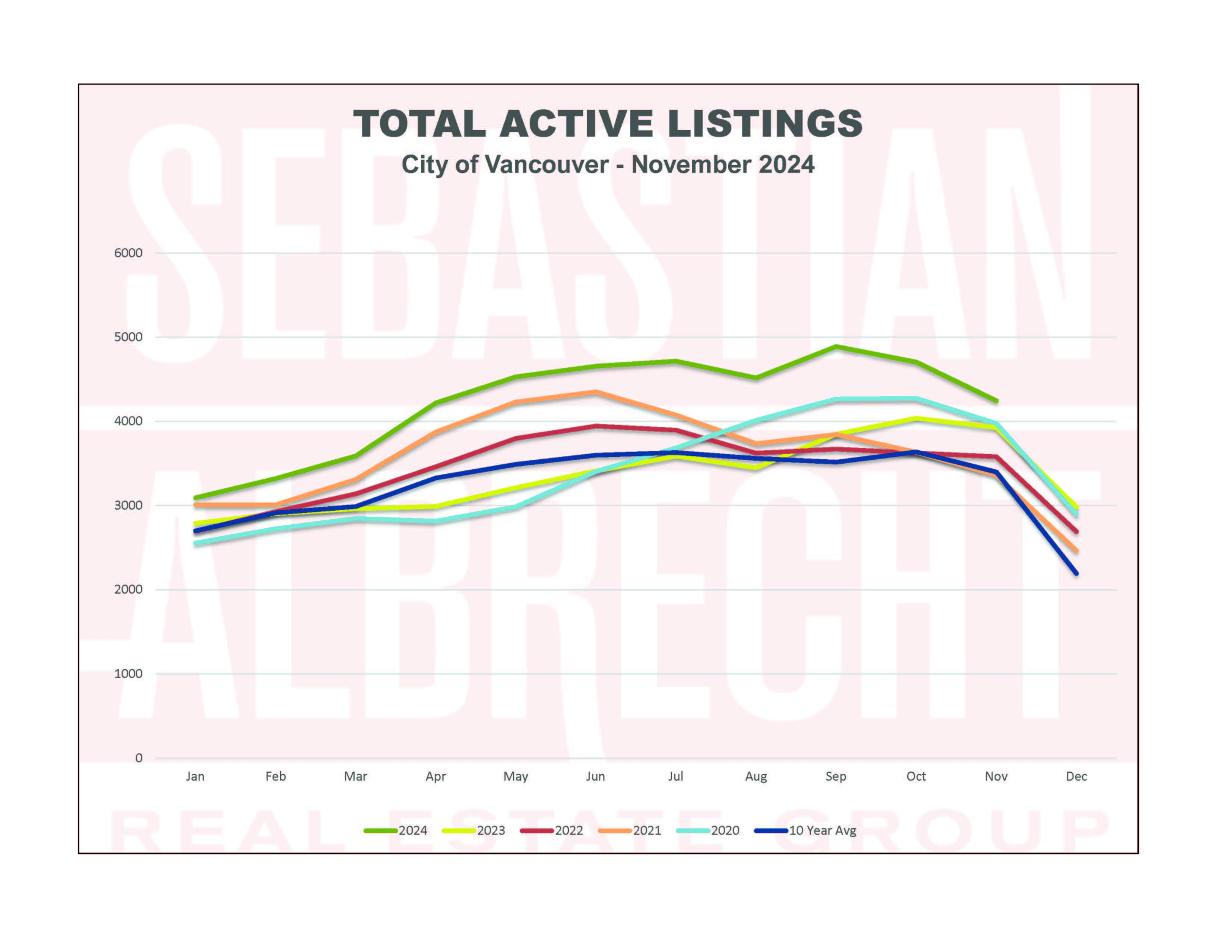

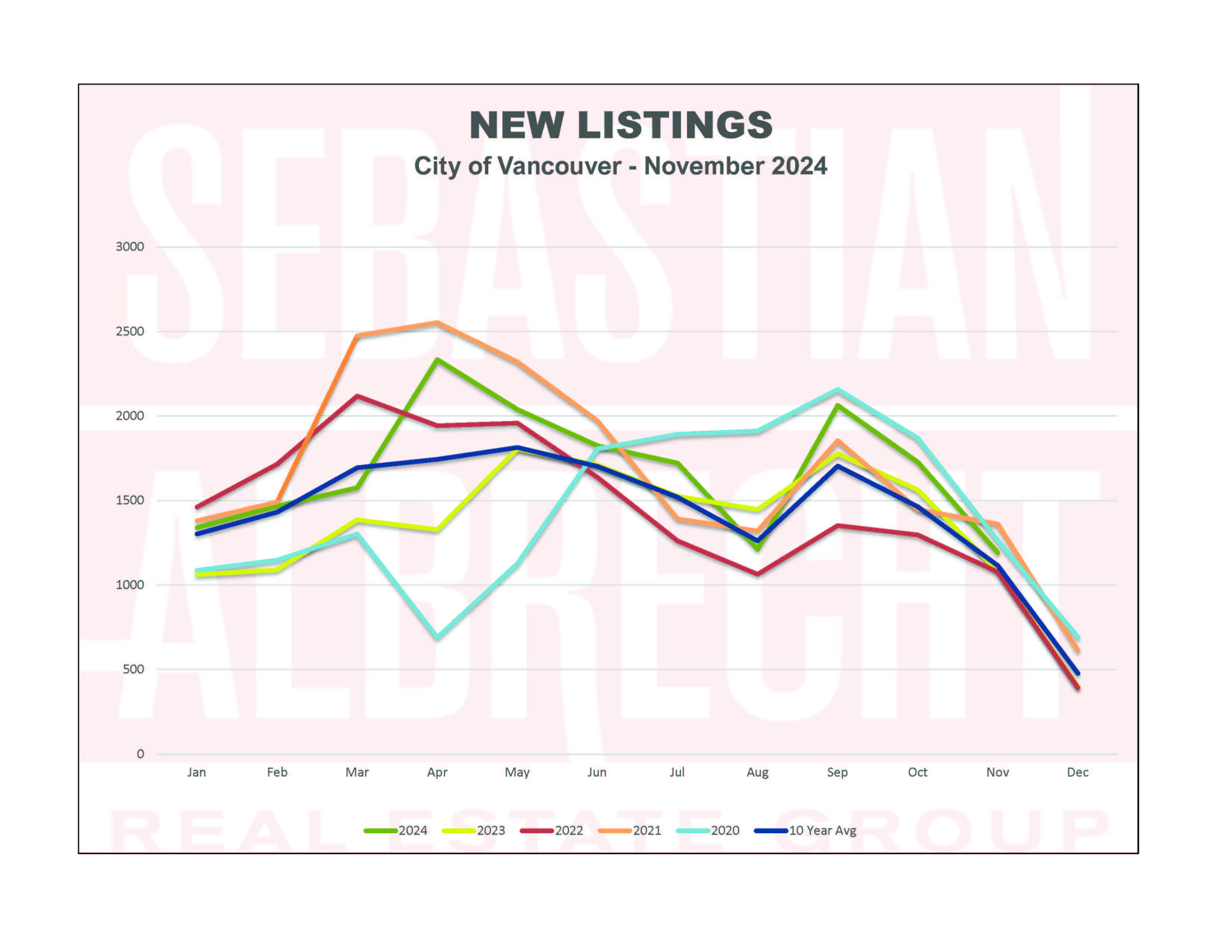

New listings fell for a second month in a row (-31% month-to-month and +10% year-to-year). This was +7% above the 10-year average. Total active listings meanwhile dropped from last month (-9.8%) but despite that drop, supply is still well above the 10-year average (+24.9%).

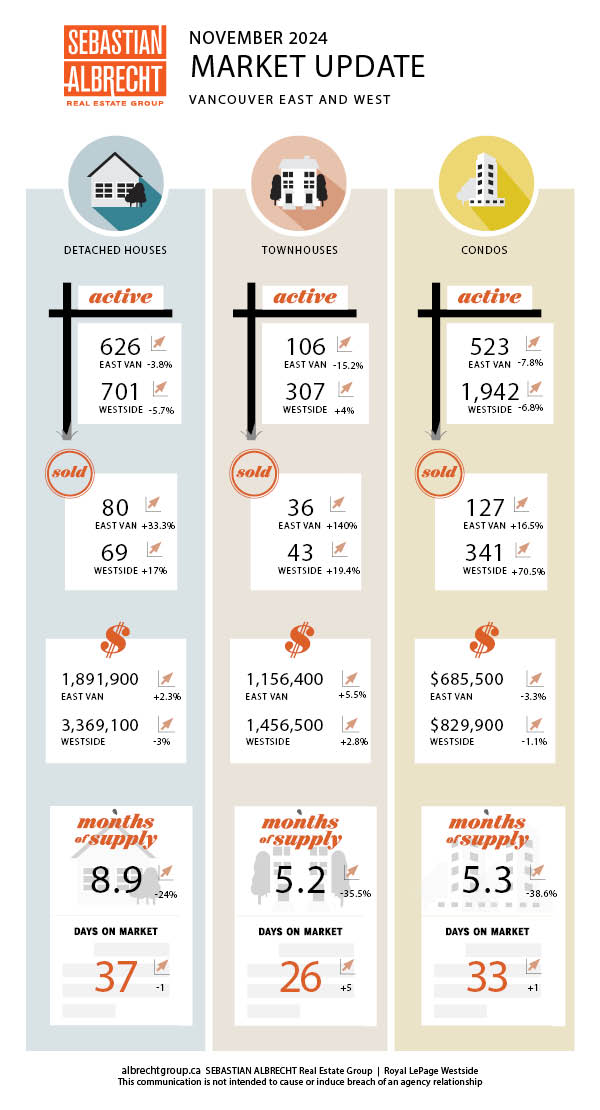

Prices continue to fluctuate. All housing types in Vancouver find themselves either flat or more expensive than a year ago...except for Westside houses (-2.3%). Over the last couple of years prices have bounced around a bit but are still hanging right around all-time highs...despite weakness in demand (and higher than usual supply).

I don't like to predict the future of Vancouver's market. It's far too complex and too many factors are unpredictable. However, my foggy crystal ball is indicating to me that we will likely have a busy spring market...or at least busier than what we had this past year. If interest rates continue to drop as we are led to believe then the shoots of life in our market that we've seen in the last couple of months may very well be foretelling what's to come.

I believe the next couple of of months will be quiet...as they typically are (due to the weather and the holidays) but they may turn out to be the perfect opportunity as eager buyers start to come back to the market to take advantage of lower interest rates early next year.

Sales fell month-to-month (-13.2%) but rose (+33%) compared to a year ago. More significantly, the number of sales last month was -9% below the 10-year average....continuing our trend this year of below-average demand, but starting to see that demand consilidate now towards the end of the year.

New listings fell for a second month in a row (-31% month-to-month and +10% year-to-year). This was +7% above the 10-year average. Total active listings meanwhile dropped from last month (-9.8%) but despite that drop, supply is still well above the 10-year average (+24.9%).

Prices continue to fluctuate. All housing types in Vancouver find themselves either flat or more expensive than a year ago...except for Westside houses (-2.3%). Over the last couple of years prices have bounced around a bit but are still hanging right around all-time highs...despite weakness in demand (and higher than usual supply).

I don't like to predict the future of Vancouver's market. It's far too complex and too many factors are unpredictable. However, my foggy crystal ball is indicating to me that we will likely have a busy spring market...or at least busier than what we had this past year. If interest rates continue to drop as we are led to believe then the shoots of life in our market that we've seen in the last couple of months may very well be foretelling what's to come.

I believe the next couple of of months will be quiet...as they typically are (due to the weather and the holidays) but they may turn out to be the perfect opportunity as eager buyers start to come back to the market to take advantage of lower interest rates early next year.

Comments:

Post Your Comment: