Vancouver’s real estate market didn’t take a sudden turn in May. The pattern we’ve been seeing in recent months of a relatively weak market shifting toward buyer’s market territory continued through May.

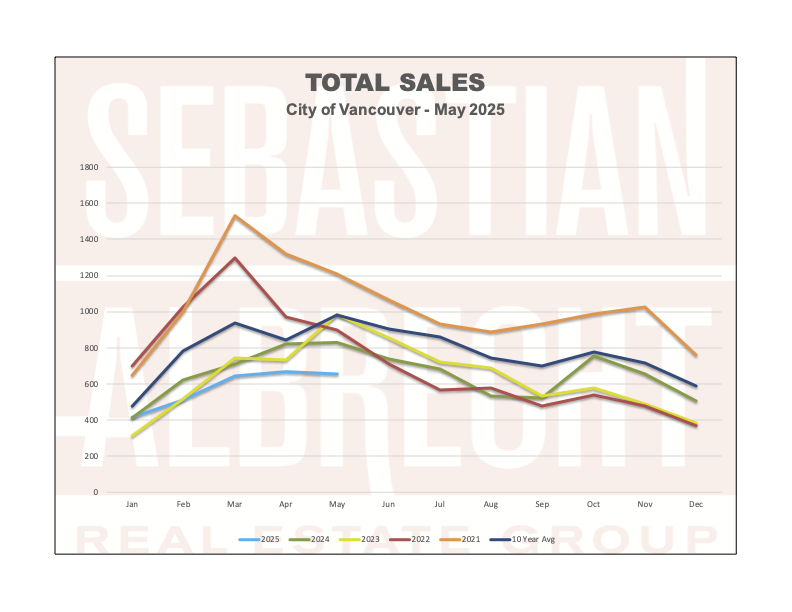

Sales hit 654 in May. This was down slightly (-2.1%) from April but a fairly significant drop of -11.5% from the previous year (and -33.4% from the 10 year average).

It’s clear that demand was stifled in May. While being down just -2.1% isn’t really a big deal…it is when you take into account the typical historical pattern in our market…which is that sales are usually highest in May and June (although in recent years the peak sales have been moving earlier in the spring - March was the peak in 2021 and 2022 - but not in 2023 or 2024).

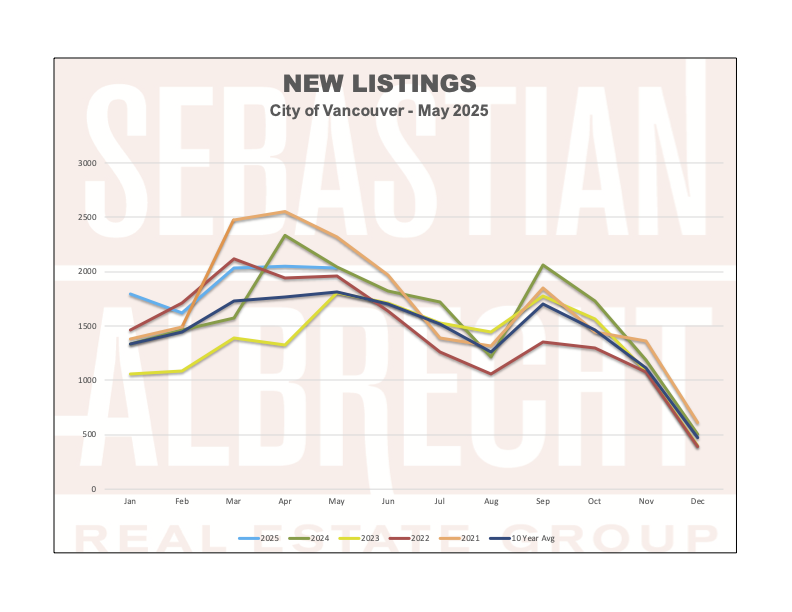

New listings followed a similar patter. They reached 2,036 which was slightly off the previous month (-0.7%) while they were +11.6% from the previous year (and +12.3% over the 10 year average).

Once again, these numbers are not following the typical spring pattern. We often see May being the peak of the spring listing season and that (so far) was not the case in 2025.

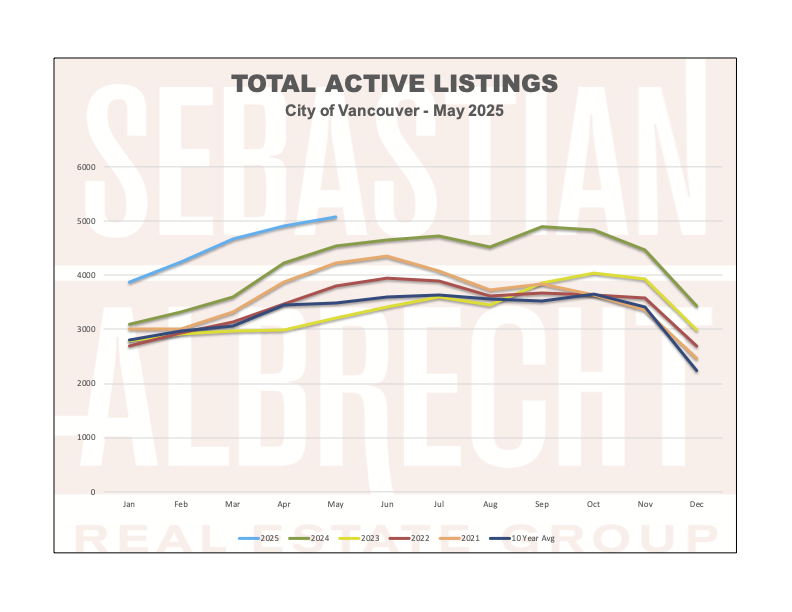

Overall, total listings rose to 5,075. This was +3.3% from the previous month and +9% over a year ago (plus a whopping +45.4% over the 10 year average).

This is the most listings we’ve had in our market in OVER A DECADE. I have to go all the way back to the summer (June) of 2012 to find another period where listings were higher than they are currently in Vancouver.

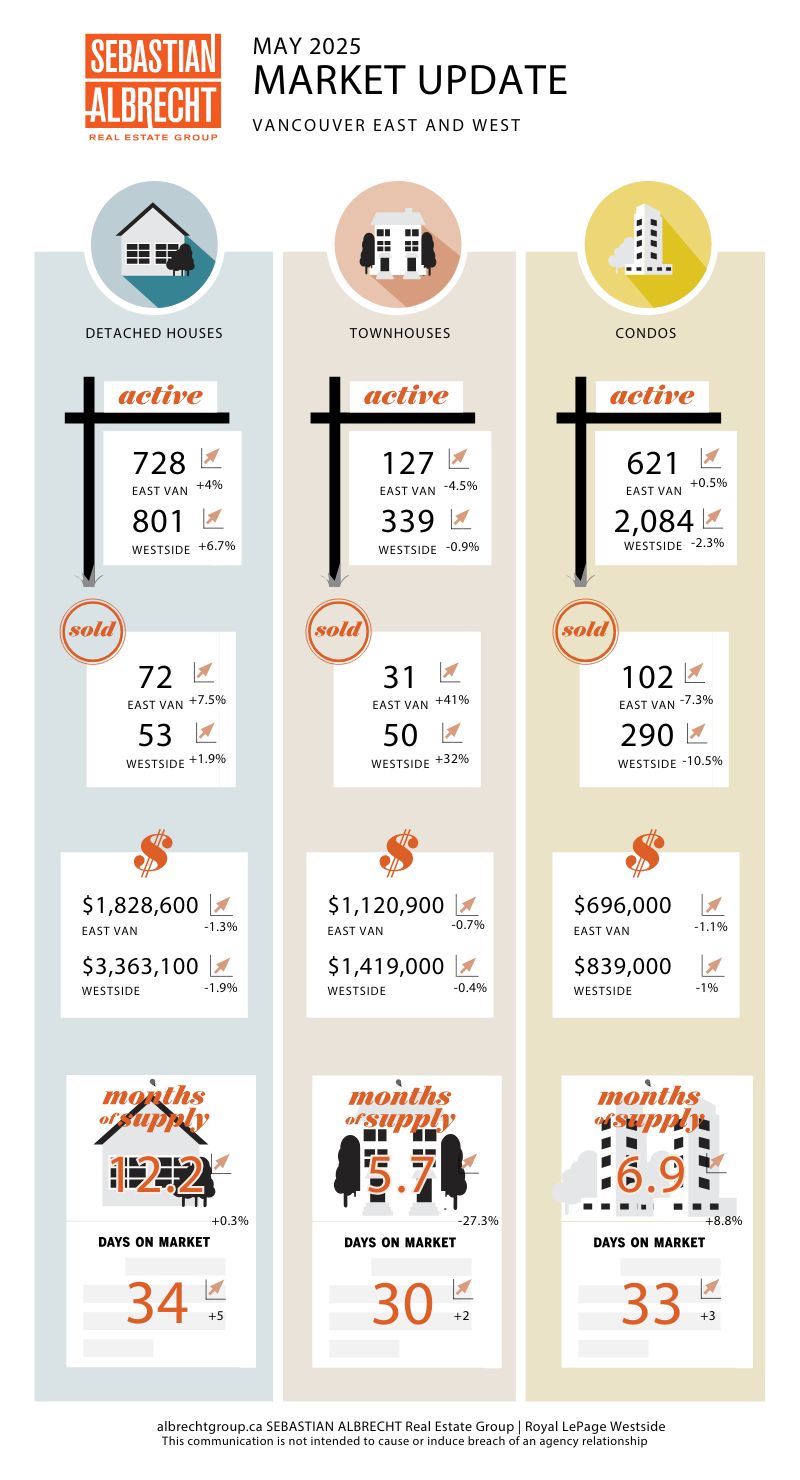

The buyers market we’ve seen in the last few months is finally having a consistent impact on prices. For the first time this year, every housing type in Vancouver saw prices decline month-over-month (albeit in relatively small amounts). Prices are also starting to see year-over-year declines as well as all property types are now at least a couple percentage points below a year ago.

The other time that we saw this market pattern (slow spring market) was back in 2020. Both in 2020 and back in 2012 the market very quickly recovered from the doldrums. In 2020 we saw a delayed/subdued spring market snap back in the fall. In 2012 the market stumbled into the fall but then recovered in the spring of 2013.

Past performance obviously doesn’t guarantee the future…but repeatedly in our market demand can only be delayed for so long. I think in the last couple months we’ve seen a lot of buyers step back due to economic uncertainty, but I’m personally (and admittedly very anecdotally) see interest (as well as confidence) rekindle in the last few weeks.

My crystal ball is forever foggy. No one can predict the future of our market (without being lucky once in a while)…but it is pretty clear that the current market is offering opportunities for buyers. There is an opportunity both in terms of the prices you’ll be paying, the options you’ll find in the market as well as your ability to negotiate with now mostly motivated sellers.

How long these market conditions will continue is anyone’s guess…

Comments:

Post Your Comment: