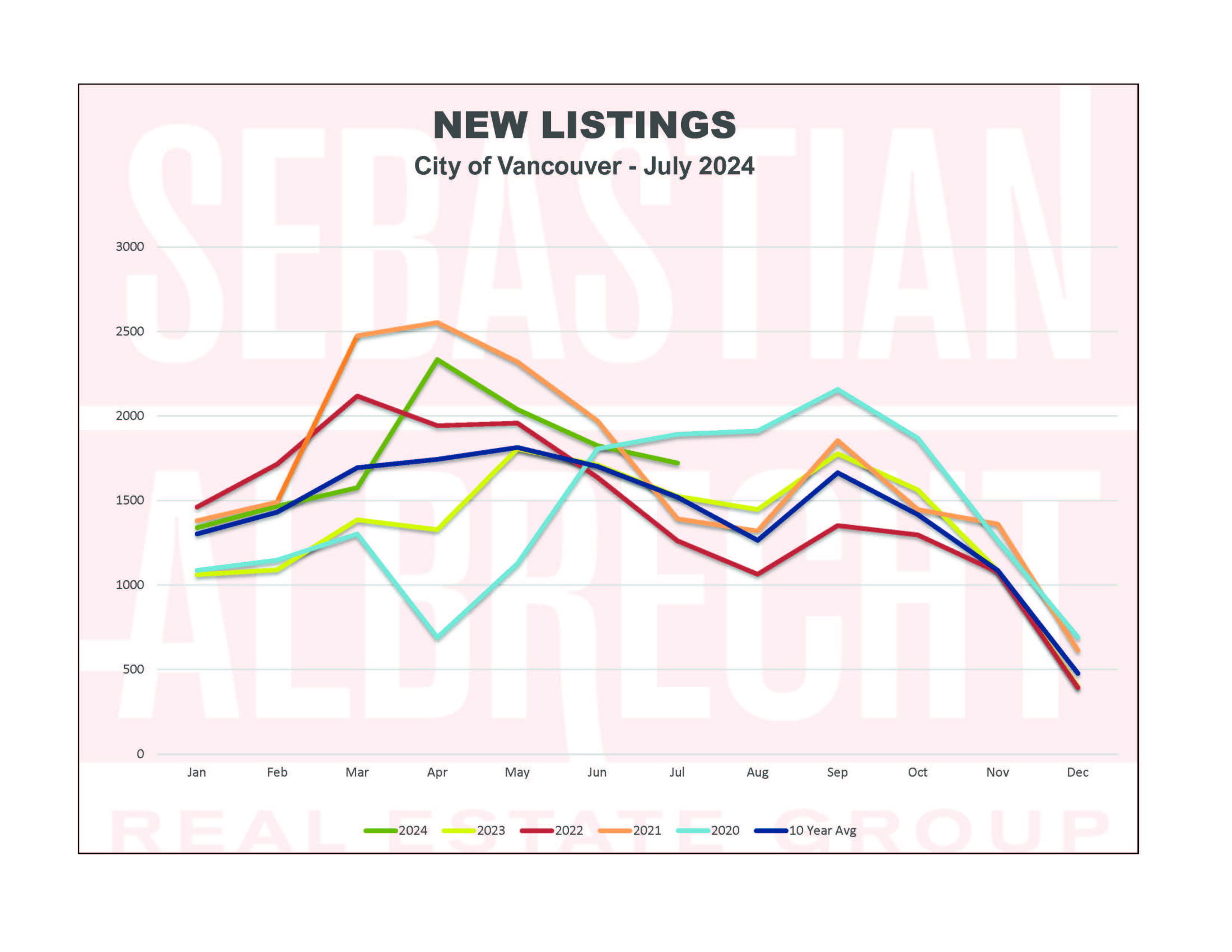

Newly listed properties rose nearly +13% in July 2024 from a year ago. This was -5.6% from the previous month but well over the 10-year average of 1,520 (+13.9%) which continued to support healthy levels of inventory in the Vancouver real estate market.

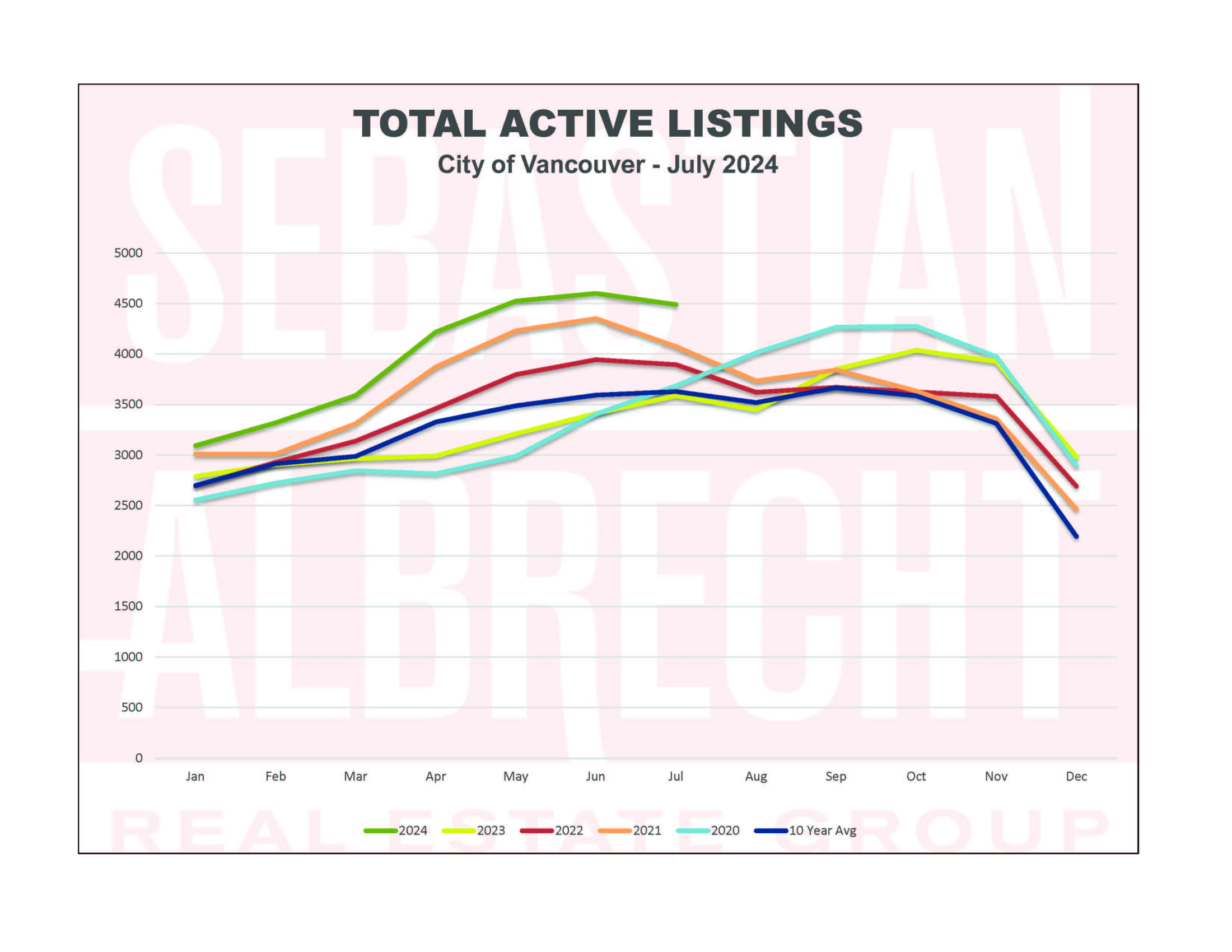

Total inventory was up +25.1% over the past year to 4,490. While this was also well above the 10-year average of 3,629 (+23,7%) it was actually a decline of -2.4% from the previous month' peak.

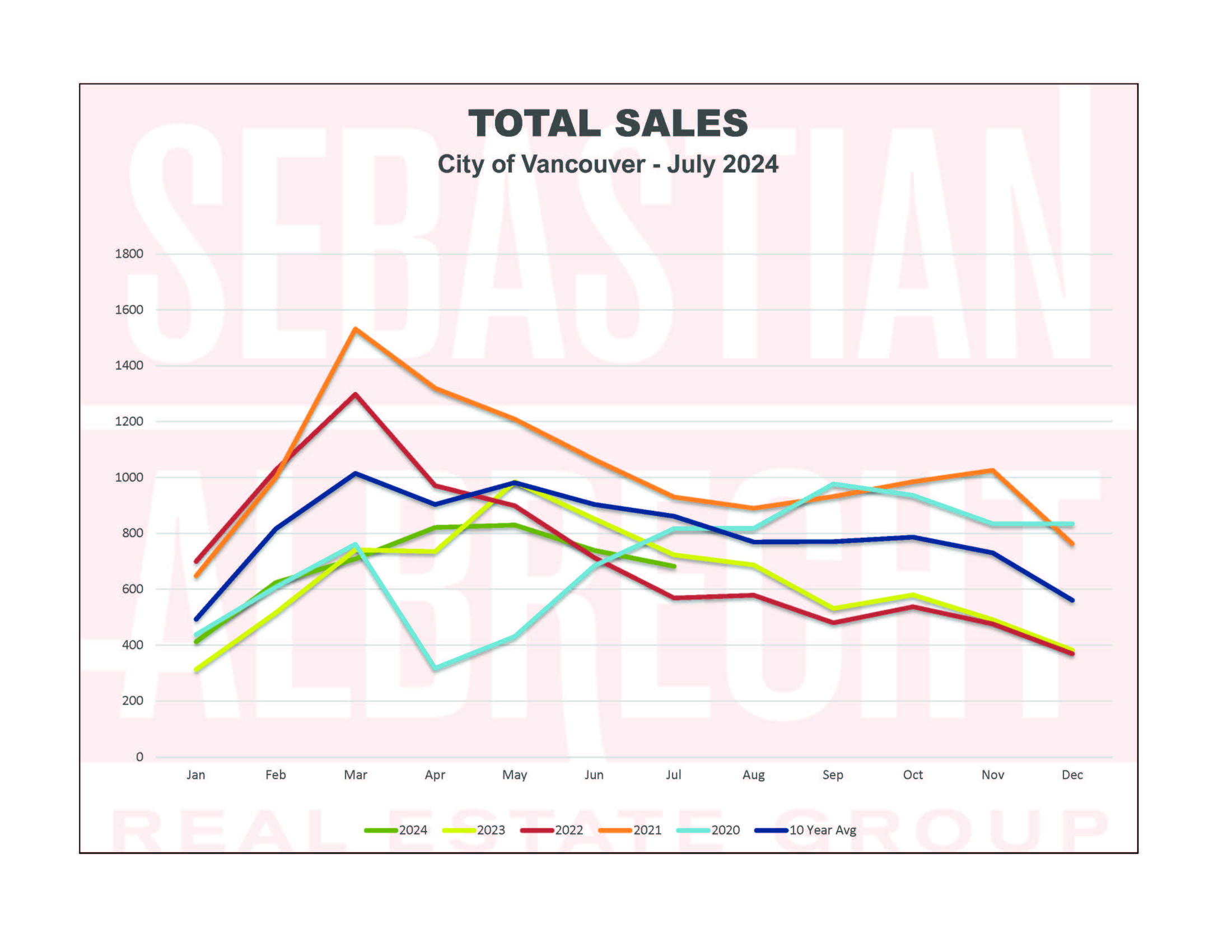

Meanwhile, on the demand side we saw sales slip in July to 682. This was a -5.7% decline from a year ago, a -7.7% drop from the previous month and -20.9% below the 10-year average.

Despite the second straight interest rate cut by the Bank of Canada, demand continues to be soft. This isn't entirely surprising given the time of year...but the elevated inventory levels and weaker demand is finally having an impact on prices.

For the first time, we saw prices drop across the board for all housing types. The most significant decline was for Townhouses on Vancouver's Westside that fell -3.2% in a single month to $1,444,700...while the least significant drop was for Westside condos that fell just -1% to $849,400.

The weakest segment of the market overall appears to be Houses on Vancouver's Westside. There's an absorption rate of just 9.7% (a full 5 basis points lower than any other category in Vancouver) in the past month and Sales dropped -15.2% over the last month.

Meanhwhile, the one category that is still in a balanced market is East Vancouver condos. Despite weakness, the 115 Sales and 530 Active Listings meant that the absorption rate reached 21.7%.

The story of our market continues to be weakness at the top end. Luxury product is proving challenging to move and seeing little demand. While the decline in interest rates hasn't made any significant, obvious changes to the overall market it is starting to impact movement at the lower end of the market...a segment dominated by first-time buyers and investors.

I suspect that we'll see August numbers to be still weaker than July. However, once the seasonally weak summer months are behind us (and possibly another interest rate cute in September) I wouldn't be suprised if we start to see our market firm up considerably...with new inventory picked up quickly.

Comments:

Post Your Comment: