While 2024 ended with a lot positive momentum, that has changed a bit at the beginning of 2025 (watch those inventory levels as I mentioned last month!).

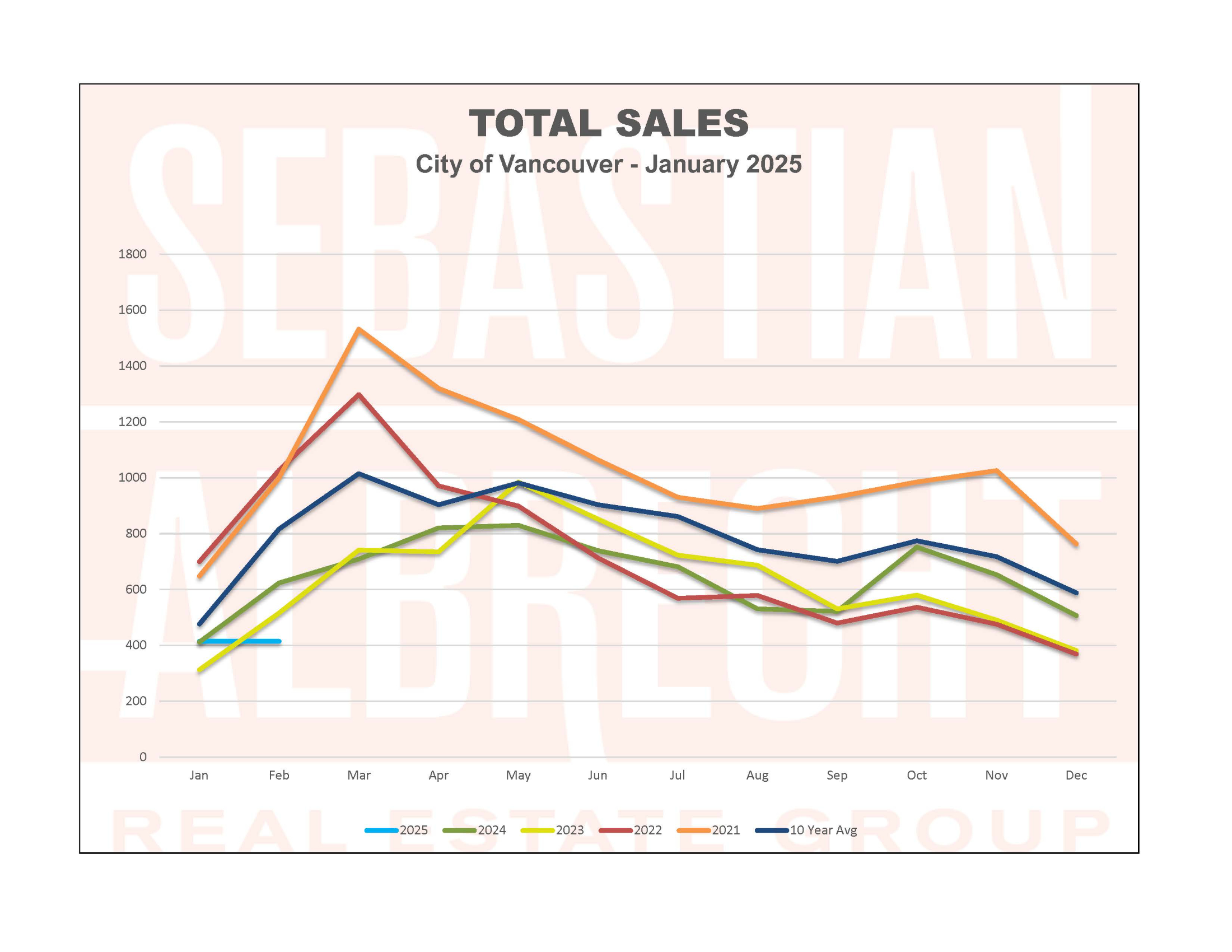

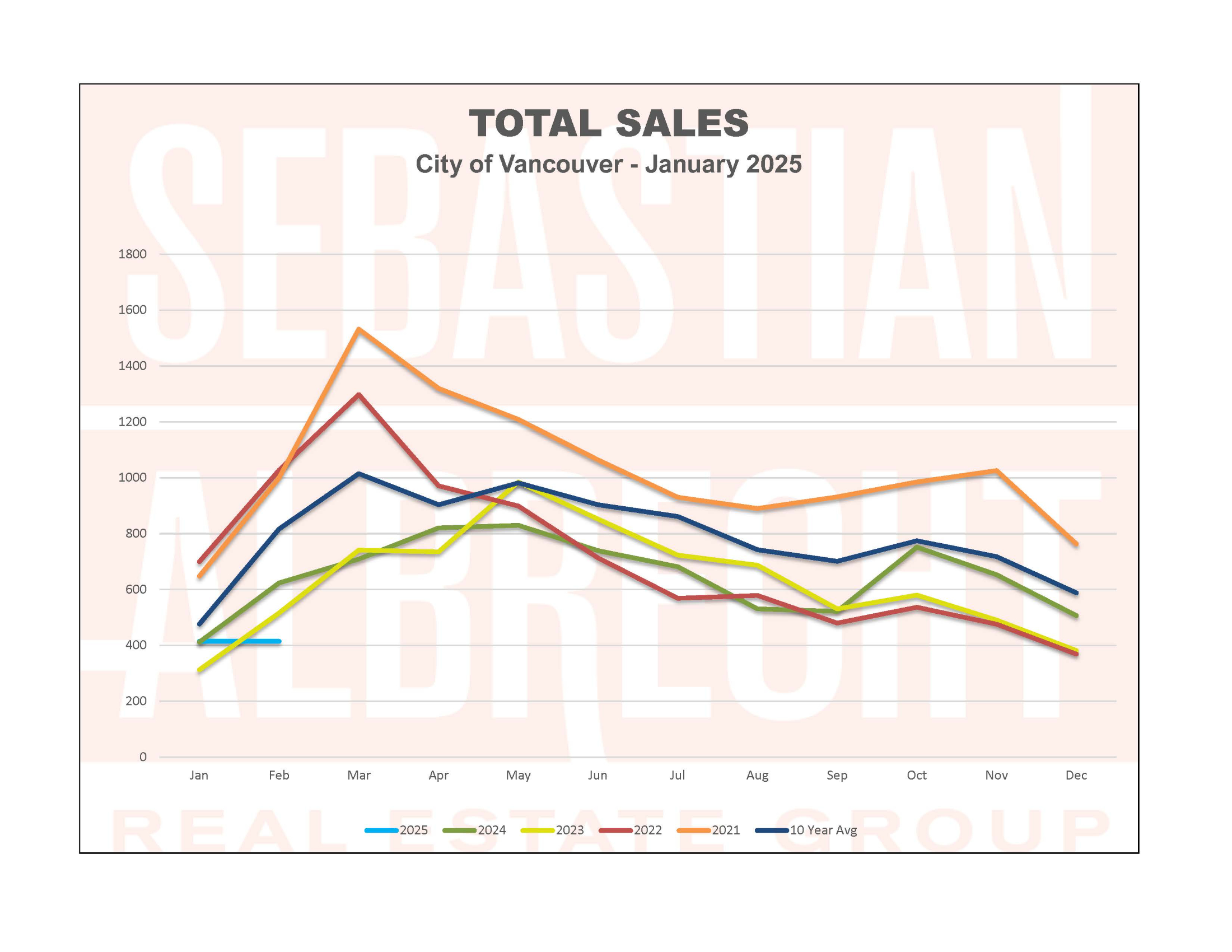

Sales remained at relatively strong levels in January 2025. They hit 415 which was about even (+0.73%) year over year and down -18.2% from the previous month. However, this was still a fairly sturdy -13% below the 10-year average.

I'm fairly comfortable with the demand side of our market condition. Especially in comparison to that 10-year average as it's trending in the right direction (heading toward the 10 year average).

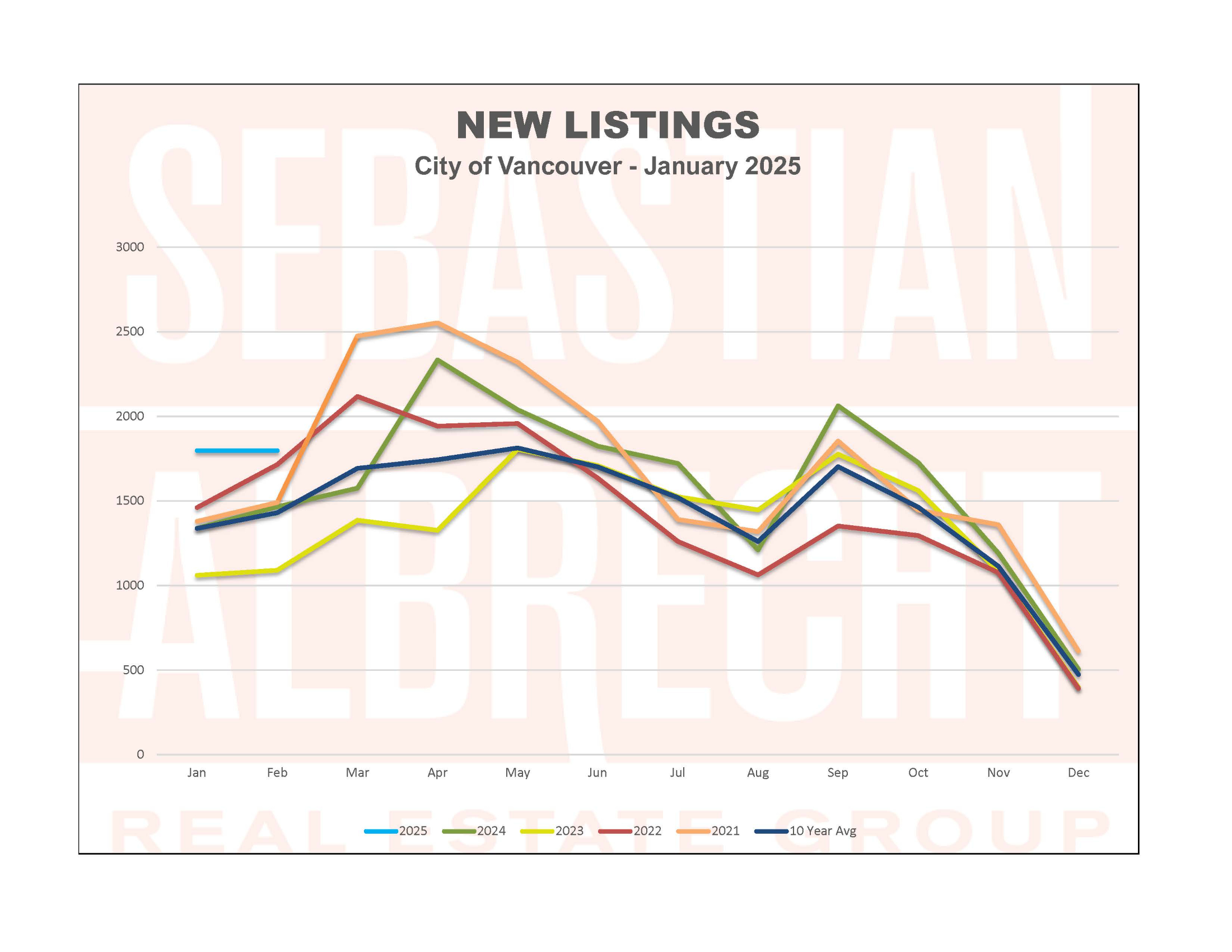

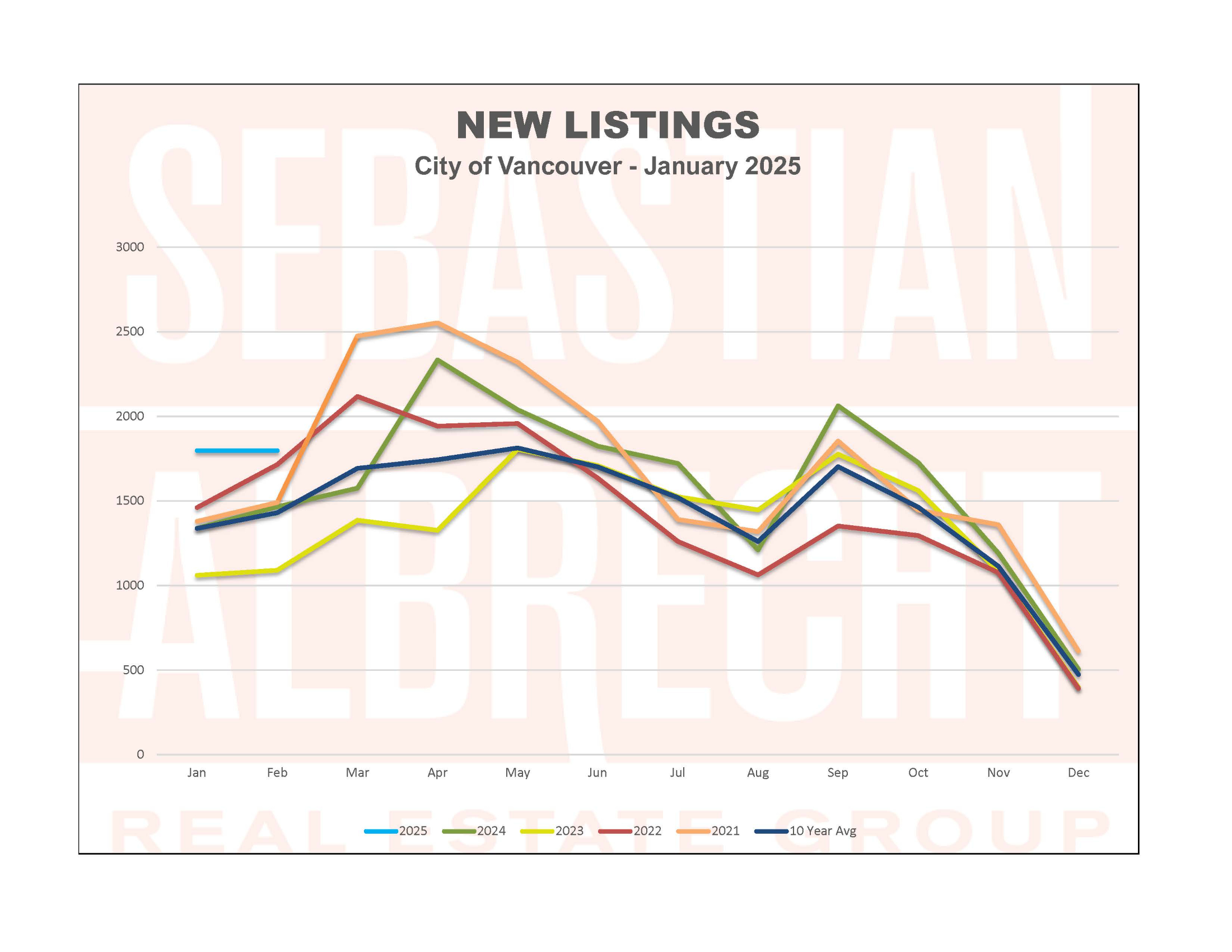

It's on the New Listings and Total Active Listings (supply) where we are seeing more activity than is typical at this time of year. New Listings reached 1,798 (+34.3% year to year and a whopping +256% rise from the previous month) which was +34.4% over the 10 year average.

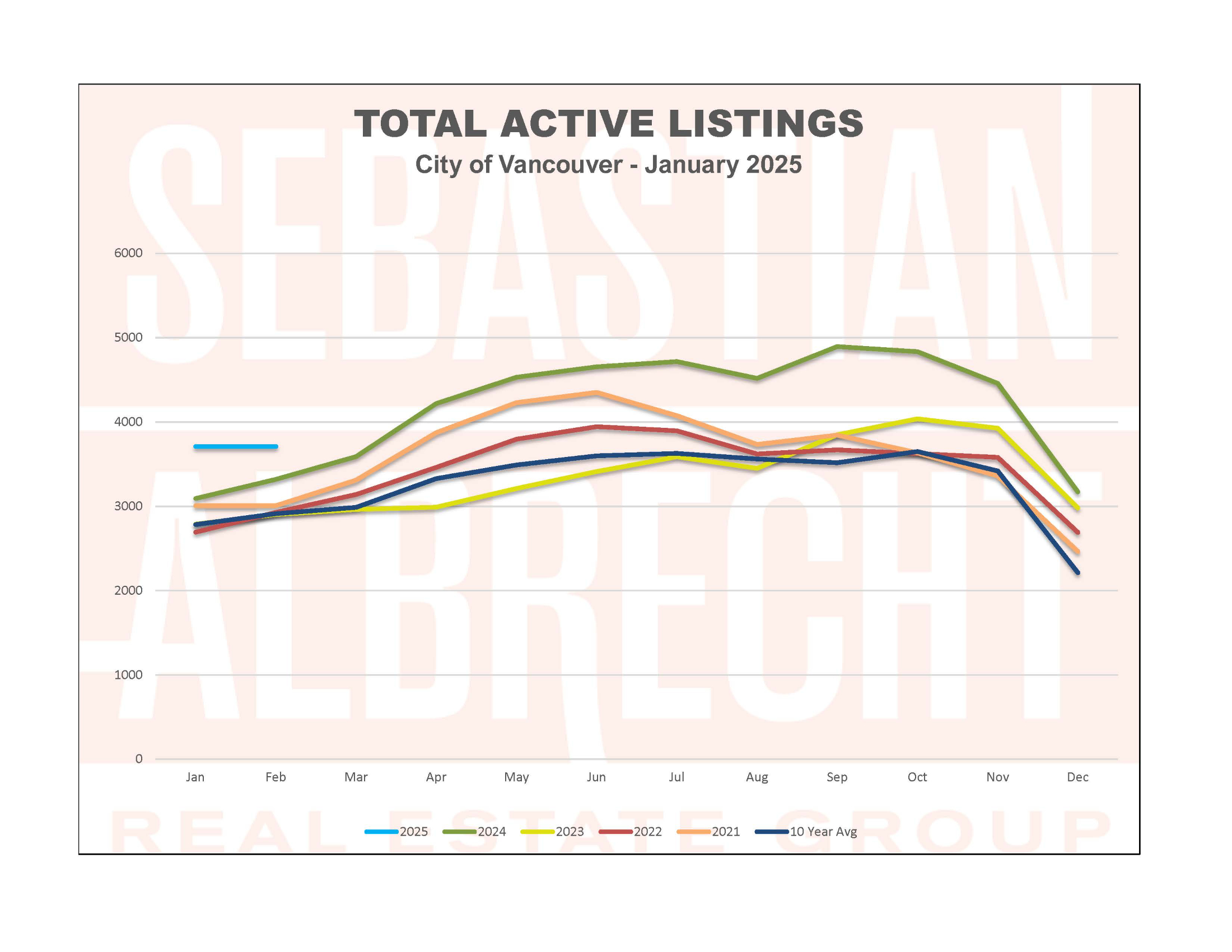

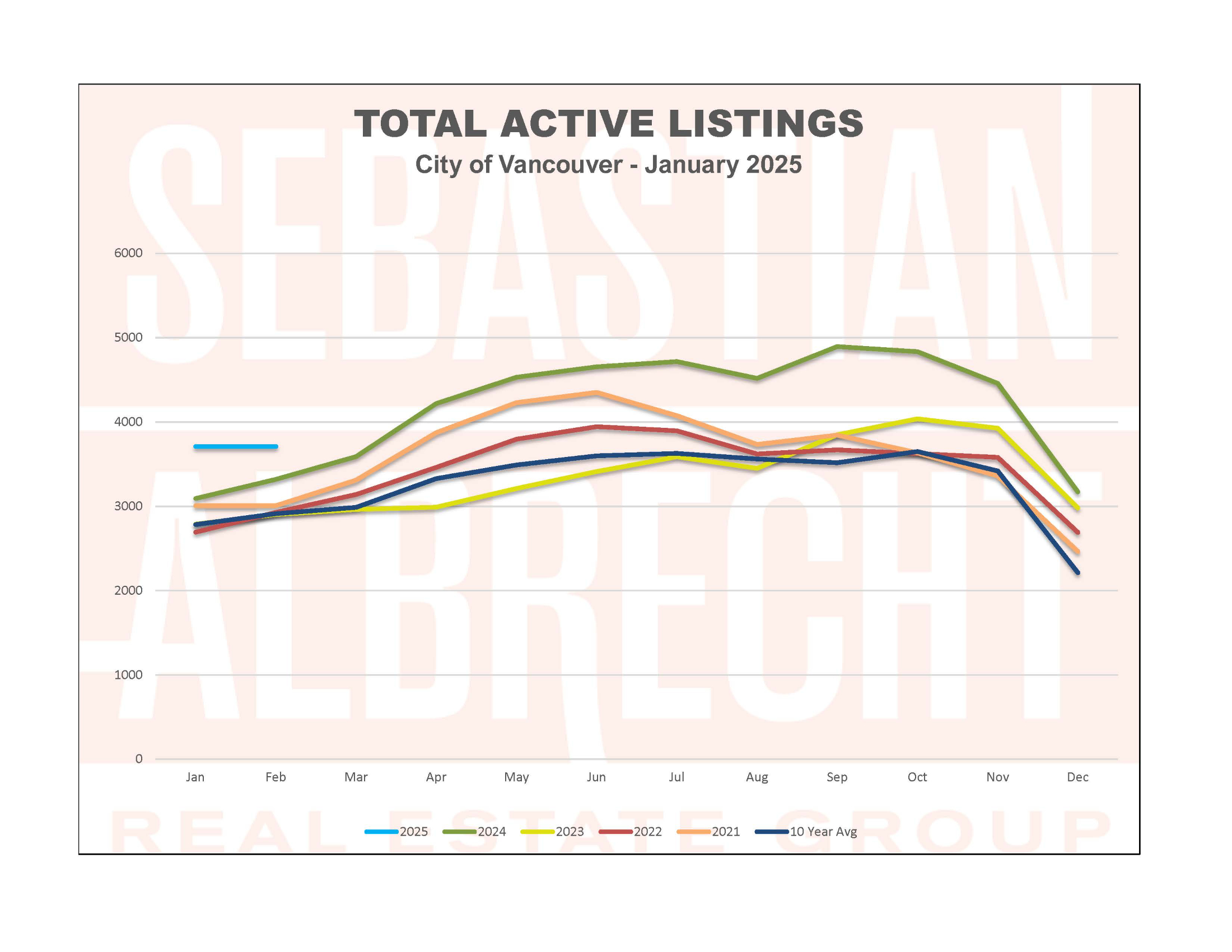

And with that, Total Active Listings were also +33.3% over the 10 year average at 3,710. That's the highest number we've seen on the market in this month since January 2009 (incidentally, arguably the beginning of when that market started to shift more from a buyer's market to a seller's market).

We had seen elevated inventory levels heading into the end of 2024. And it appears we are not yet rid of that inventory...much of the new listings today are failed listings from the tail-end of 2024 that did not sell.

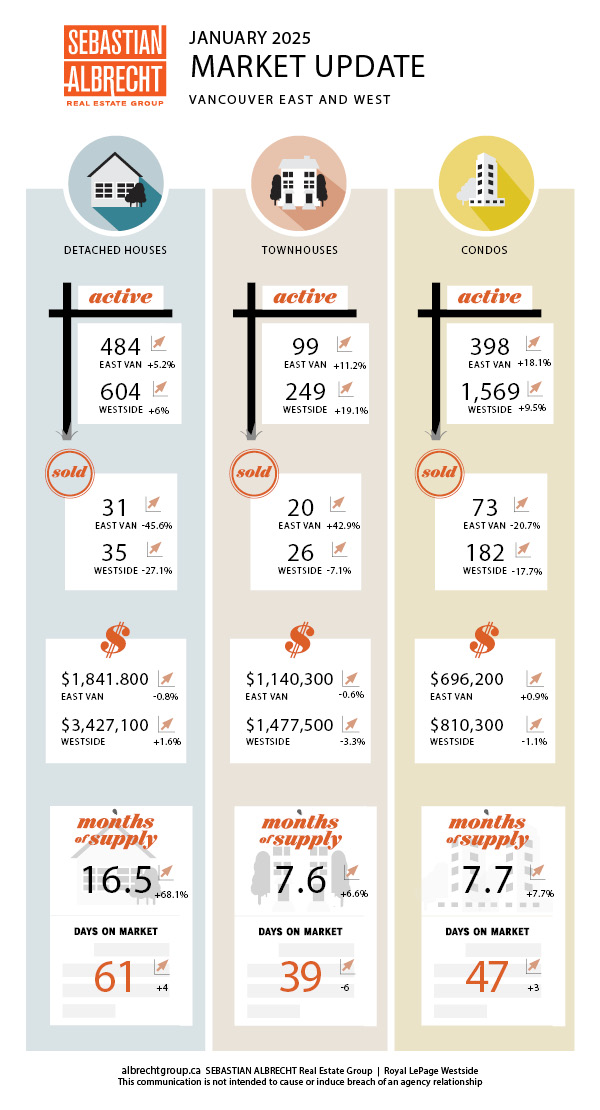

As I've discussed previously, the increased supply did not relate into any kind of significant drop in home prices. Over the last 4 years we've been floating very closely with the peak pricing seen back in the Spring of 2021 as our market continues to be remarkably robust price-wise.

That being said, prices have once again been drifting lower for most housing in types in most regions of Metro Vancouver. I'm still of the mind that this excess supply will be swallowed up as interest rates continue to fall...but obviously, there are also some new macro-economic issues at play that may impact our market.

Personally, I think Vancouver's real estate market will continue to be robust no matter the headwinds. Recent history has shown our market to be remarkably resilient.

Sales remained at relatively strong levels in January 2025. They hit 415 which was about even (+0.73%) year over year and down -18.2% from the previous month. However, this was still a fairly sturdy -13% below the 10-year average.

I'm fairly comfortable with the demand side of our market condition. Especially in comparison to that 10-year average as it's trending in the right direction (heading toward the 10 year average).

It's on the New Listings and Total Active Listings (supply) where we are seeing more activity than is typical at this time of year. New Listings reached 1,798 (+34.3% year to year and a whopping +256% rise from the previous month) which was +34.4% over the 10 year average.

And with that, Total Active Listings were also +33.3% over the 10 year average at 3,710. That's the highest number we've seen on the market in this month since January 2009 (incidentally, arguably the beginning of when that market started to shift more from a buyer's market to a seller's market).

We had seen elevated inventory levels heading into the end of 2024. And it appears we are not yet rid of that inventory...much of the new listings today are failed listings from the tail-end of 2024 that did not sell.

As I've discussed previously, the increased supply did not relate into any kind of significant drop in home prices. Over the last 4 years we've been floating very closely with the peak pricing seen back in the Spring of 2021 as our market continues to be remarkably robust price-wise.

That being said, prices have once again been drifting lower for most housing in types in most regions of Metro Vancouver. I'm still of the mind that this excess supply will be swallowed up as interest rates continue to fall...but obviously, there are also some new macro-economic issues at play that may impact our market.

Personally, I think Vancouver's real estate market will continue to be robust no matter the headwinds. Recent history has shown our market to be remarkably resilient.

Comments:

Post Your Comment: