Momentum. I think that's the key word to describe the Vancouver real estate market as 2024 wraps up.

For the last couple of years we've seen a lot of sideways movement. A few months in one direction and then a few in another...but ultimately, we've stayed pretty flat since hitting all-time highs in the Spring of 2022.

Most of 2024 was marked by a decided lack of enthusiasm and confidence in the market. While demand didn't fall off a cliff it bounced along the lower end of historical norms (typically about 20-30% below the 10-year averages).

What was different in 2024 was that we finally saw supply increase significantly. Back in 2023 (a year also marked by low demand but also low inventory) prognosticators predicted that IF supply increased significantly then prices would start to fall in Vancouver...that being the obvious basic economic principle of supply and demand.

However, that just didn't happen in 2024. Prices remained remarkably resilient (something that I get more into in my video which is linked below or you can click here to watch).

...and then toward the end of the year we started to see demand normalize to more typically historic 10-year averages as interest rates began to fall (supply was trending down but still at higher levels).

And this is the momentum that continued through December.

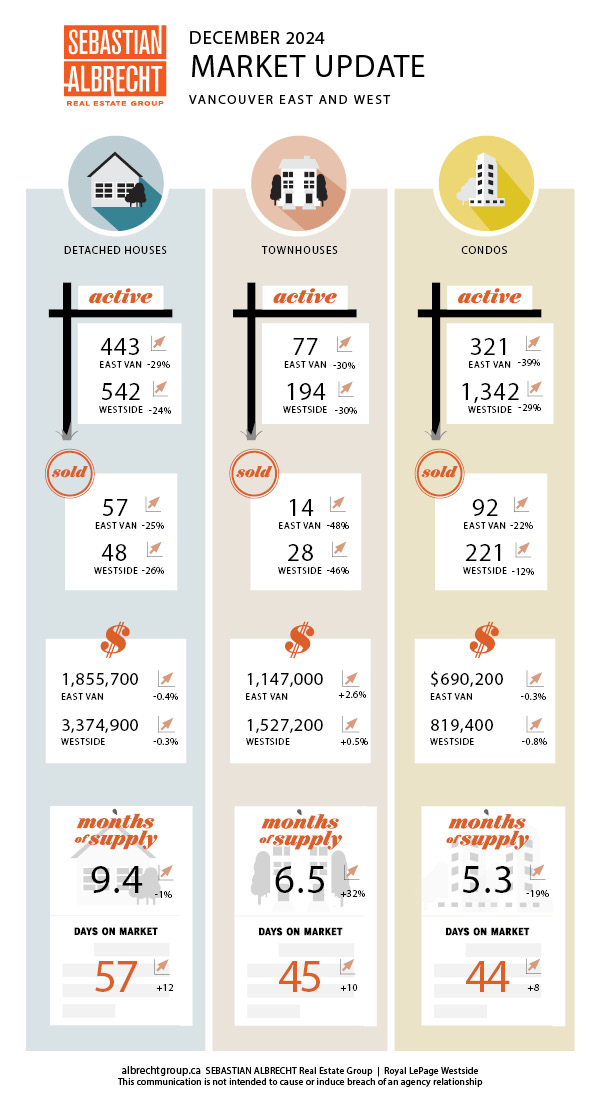

The 507 sales in December 2024 were nearly 33% higher than a year ago (albeit -22% from the previous month which is a normal historic pattern at the end of the year). This was also about -14% under the 10-year average but still a huge improvement over the -20% - -25% we spent much of the year fluctuating between.

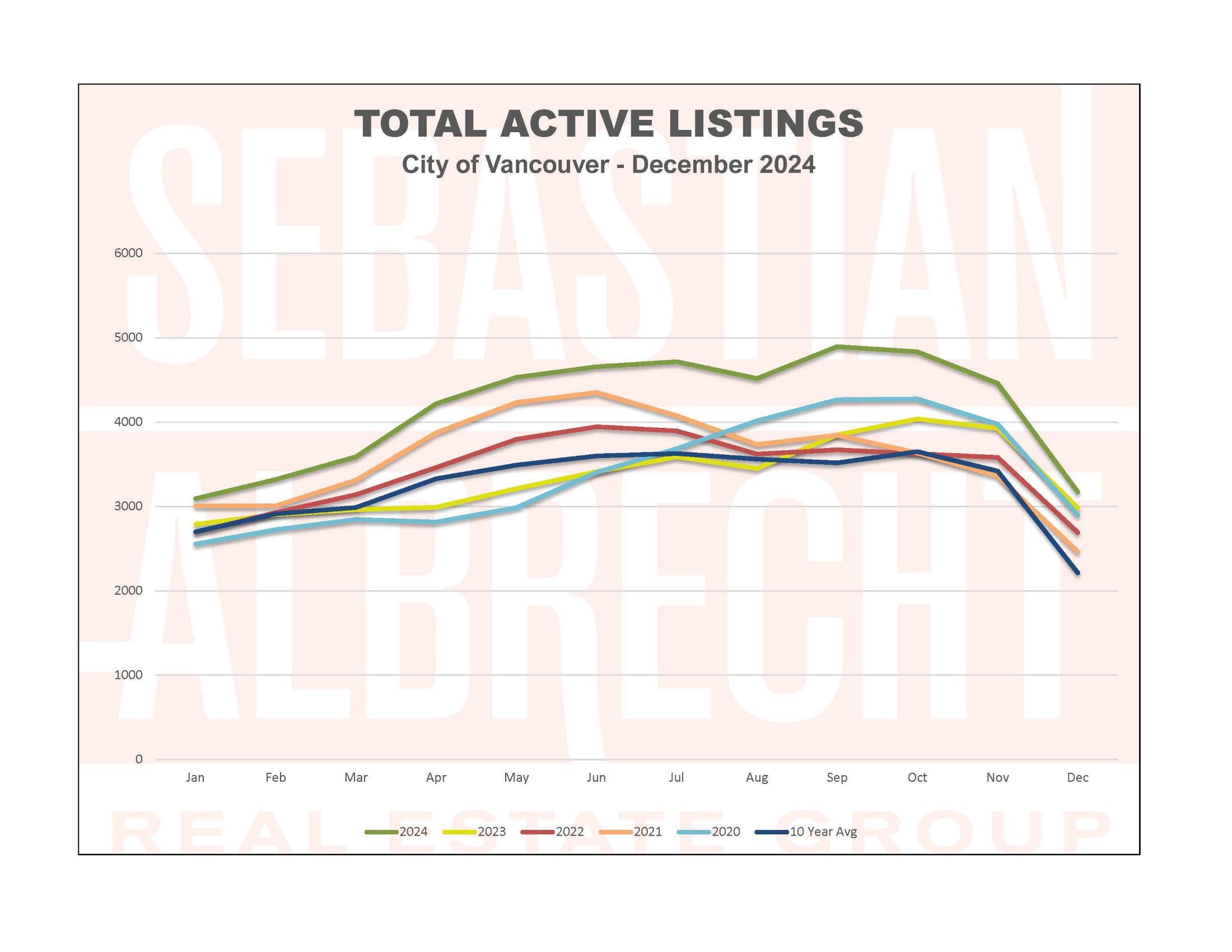

New Listings dropped precipitously from the previous month (-58%) which was +27% higher than a year ago and also about 7% over the 10-year average. The 3172 Active Listings were -29% lower than the previous month (a normal historic pattern) but up +6% over a year ago and a whopping +43% over the 10-year average.

It's this last number that gives me pause. In a year of high inventory levels that's the most elevated we've seen inventory in the entire year (not in total numbers but in comparison to the 10-year average).

I believe that we will start seeing demand pick up in the coming months (with falling interest rates) and that the higher inventory levels will moderate as that happens. I'm seeing the next few months as being a perfect opportunity for buyers to enter into the market without signficant competition and with more selection...a situation that's not that typical of our market in the last 20-30 years.

For the last couple of years we've seen a lot of sideways movement. A few months in one direction and then a few in another...but ultimately, we've stayed pretty flat since hitting all-time highs in the Spring of 2022.

Most of 2024 was marked by a decided lack of enthusiasm and confidence in the market. While demand didn't fall off a cliff it bounced along the lower end of historical norms (typically about 20-30% below the 10-year averages).

What was different in 2024 was that we finally saw supply increase significantly. Back in 2023 (a year also marked by low demand but also low inventory) prognosticators predicted that IF supply increased significantly then prices would start to fall in Vancouver...that being the obvious basic economic principle of supply and demand.

However, that just didn't happen in 2024. Prices remained remarkably resilient (something that I get more into in my video which is linked below or you can click here to watch).

...and then toward the end of the year we started to see demand normalize to more typically historic 10-year averages as interest rates began to fall (supply was trending down but still at higher levels).

And this is the momentum that continued through December.

The 507 sales in December 2024 were nearly 33% higher than a year ago (albeit -22% from the previous month which is a normal historic pattern at the end of the year). This was also about -14% under the 10-year average but still a huge improvement over the -20% - -25% we spent much of the year fluctuating between.

New Listings dropped precipitously from the previous month (-58%) which was +27% higher than a year ago and also about 7% over the 10-year average. The 3172 Active Listings were -29% lower than the previous month (a normal historic pattern) but up +6% over a year ago and a whopping +43% over the 10-year average.

It's this last number that gives me pause. In a year of high inventory levels that's the most elevated we've seen inventory in the entire year (not in total numbers but in comparison to the 10-year average).

I believe that we will start seeing demand pick up in the coming months (with falling interest rates) and that the higher inventory levels will moderate as that happens. I'm seeing the next few months as being a perfect opportunity for buyers to enter into the market without signficant competition and with more selection...a situation that's not that typical of our market in the last 20-30 years.

Comments:

Post Your Comment: