As I predicted last month, December 2023 was another "weak" month in Vancouver's real estate market. All market activity continued the decline that started in November.

But as mentioned last month, this is normal market activity at this time of year. There's (almost) always a sharp decline of activity through the end of the year as most of us focus on family, vacations and holidays.

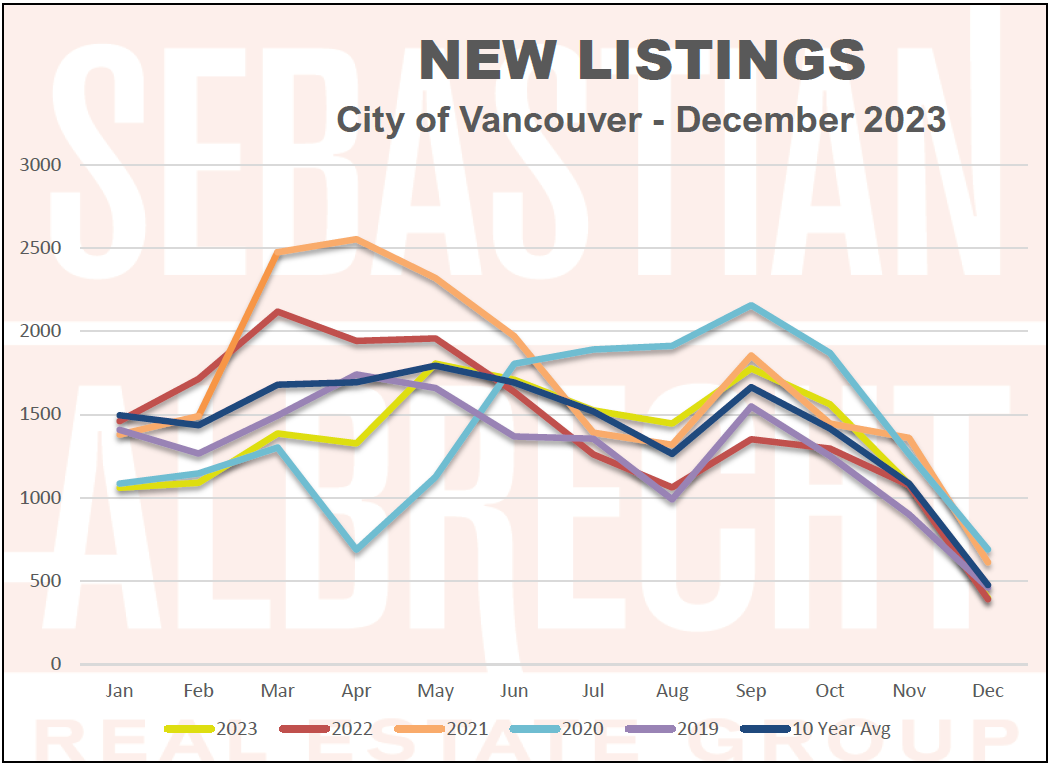

This year was no exception, but activity levels did fall sharper than we would usually see...with levels falling well below the 10-year average.

Sales fell to 382. This was down -22.2% from last month (but up +3.5% from last year) and off a whopping -31.9% from the 10-year average.

New Listings dropped to 398, down -63.3% from last month (but up +1.5% from a year ago). This was down -16.5% from the 10-year average.

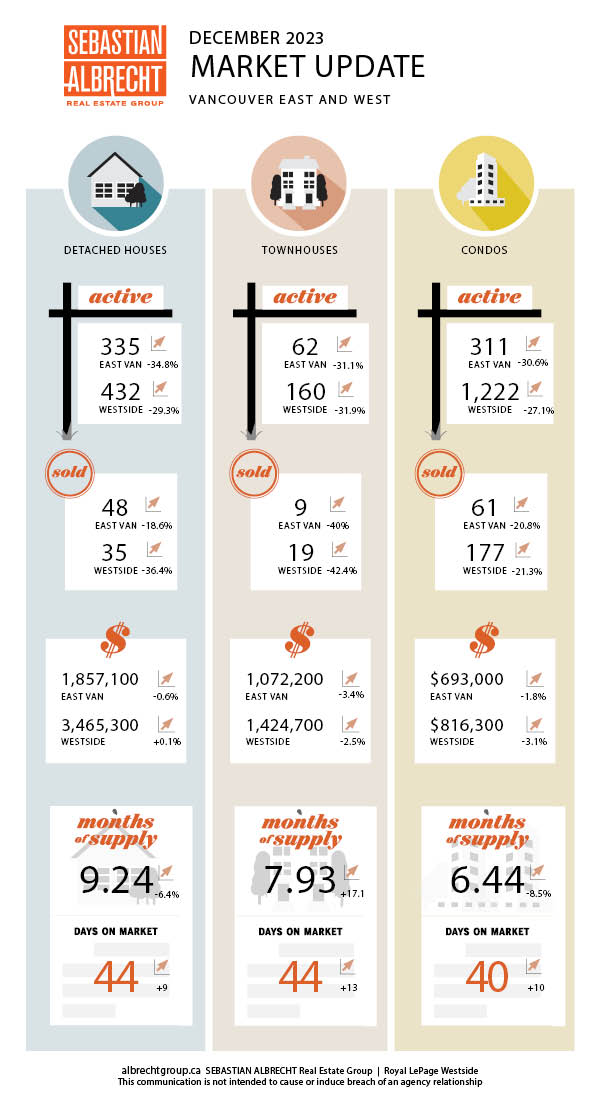

This combined for a total of 2,735 Active Listings in Vancouver at the end of December. Up +24.7% over the 10-year average but down -24.5% from last month and up +1.82% from last year.

The result of softer demand over the last couple of months has had prices decrease. This past month saw all property types across Vancouver decline for the first time this year, from Westside Houses seeing a 0.1% decline to East Vancouver Townhouses with a -3.4% decline in a single month.

All in all, we've seen a "weak" market in Vancouver over the last six months. With interest rates 3x what they were before rates were hiked our market has shown remarkable resilience.

While prices have declined in recent months, we are still up across the board for the year. Westside Houses are up +12.8% and East Vancouver Houses up +10.7% annually....all in an environment of escalating interest rates.

It's very clear that there is still tremendous demand for homes in Vancouver. That demand has been deferred over the last 18 months or so. Should interest rates decline (bank rates have been coming down in recent weeks already) the sense is that it could ignite our market once again.

But as mentioned last month, this is normal market activity at this time of year. There's (almost) always a sharp decline of activity through the end of the year as most of us focus on family, vacations and holidays.

This year was no exception, but activity levels did fall sharper than we would usually see...with levels falling well below the 10-year average.

Sales fell to 382. This was down -22.2% from last month (but up +3.5% from last year) and off a whopping -31.9% from the 10-year average.

New Listings dropped to 398, down -63.3% from last month (but up +1.5% from a year ago). This was down -16.5% from the 10-year average.

This combined for a total of 2,735 Active Listings in Vancouver at the end of December. Up +24.7% over the 10-year average but down -24.5% from last month and up +1.82% from last year.

The result of softer demand over the last couple of months has had prices decrease. This past month saw all property types across Vancouver decline for the first time this year, from Westside Houses seeing a 0.1% decline to East Vancouver Townhouses with a -3.4% decline in a single month.

All in all, we've seen a "weak" market in Vancouver over the last six months. With interest rates 3x what they were before rates were hiked our market has shown remarkable resilience.

While prices have declined in recent months, we are still up across the board for the year. Westside Houses are up +12.8% and East Vancouver Houses up +10.7% annually....all in an environment of escalating interest rates.

It's very clear that there is still tremendous demand for homes in Vancouver. That demand has been deferred over the last 18 months or so. Should interest rates decline (bank rates have been coming down in recent weeks already) the sense is that it could ignite our market once again.

Comments:

Post Your Comment: