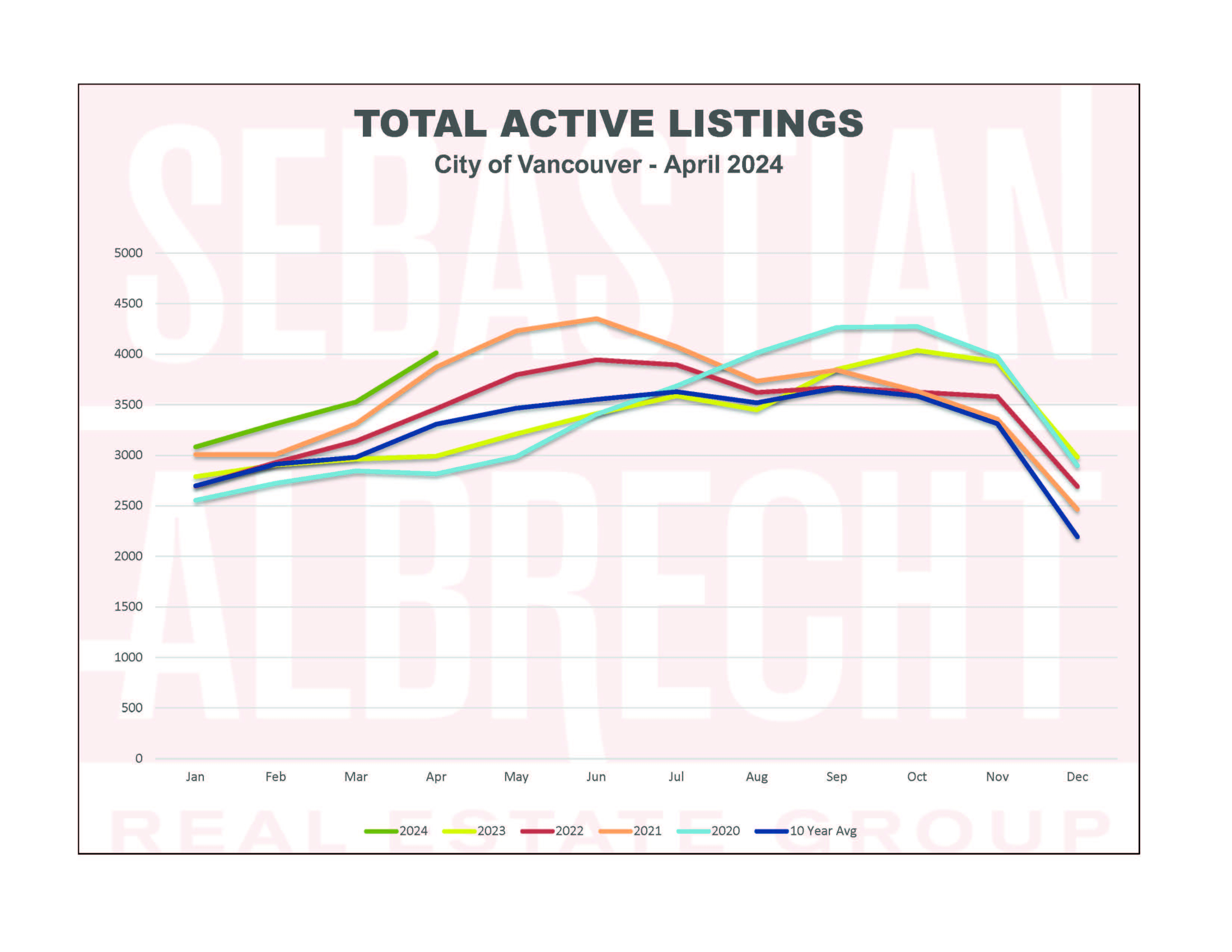

The big headline from the GVR is that overall listing inventory reached heights not seen since the summer of 2020...when our market was deep in the doldrums of COVID isolation.

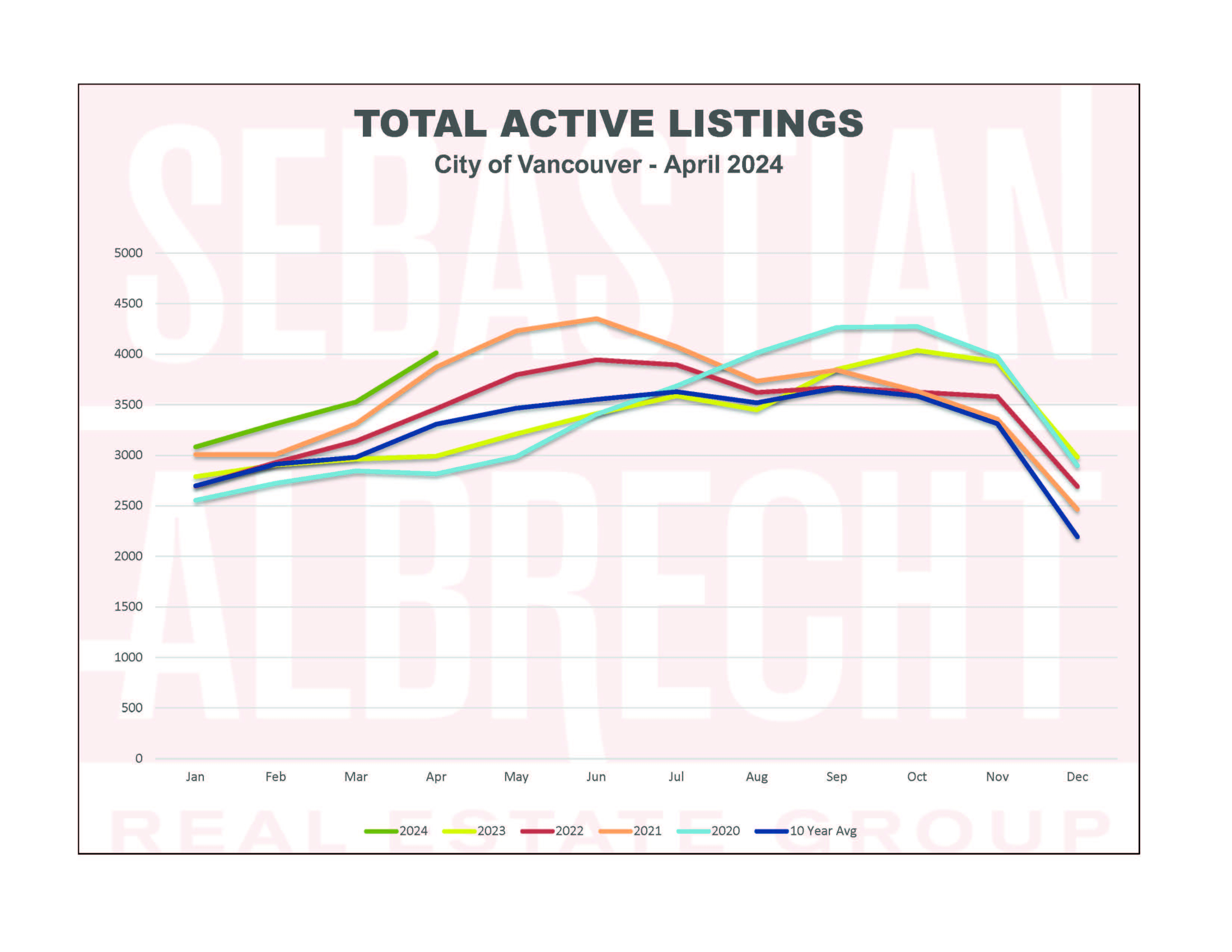

However, this is actually not the case in Vancouver. While our inventory levels have risen sharply since the beginning of the year (from a low of 3,083 to a high of 4,014) this is a fairly typical pattern for the spring.

We've actually seen this level of inventory multiple times over the last four years...in the fall of last year, through the summer of 2021 and very nearly (not quite) in June 2022.

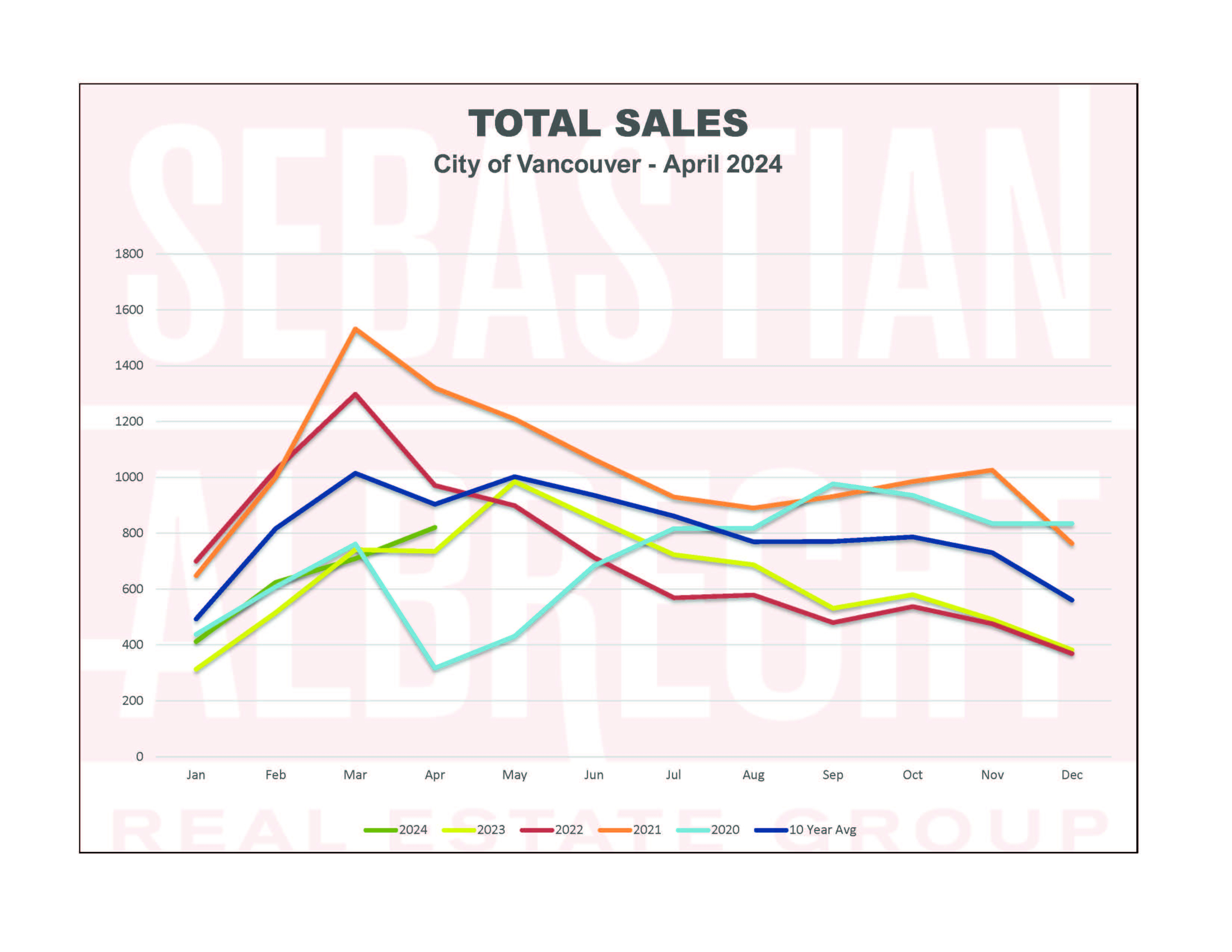

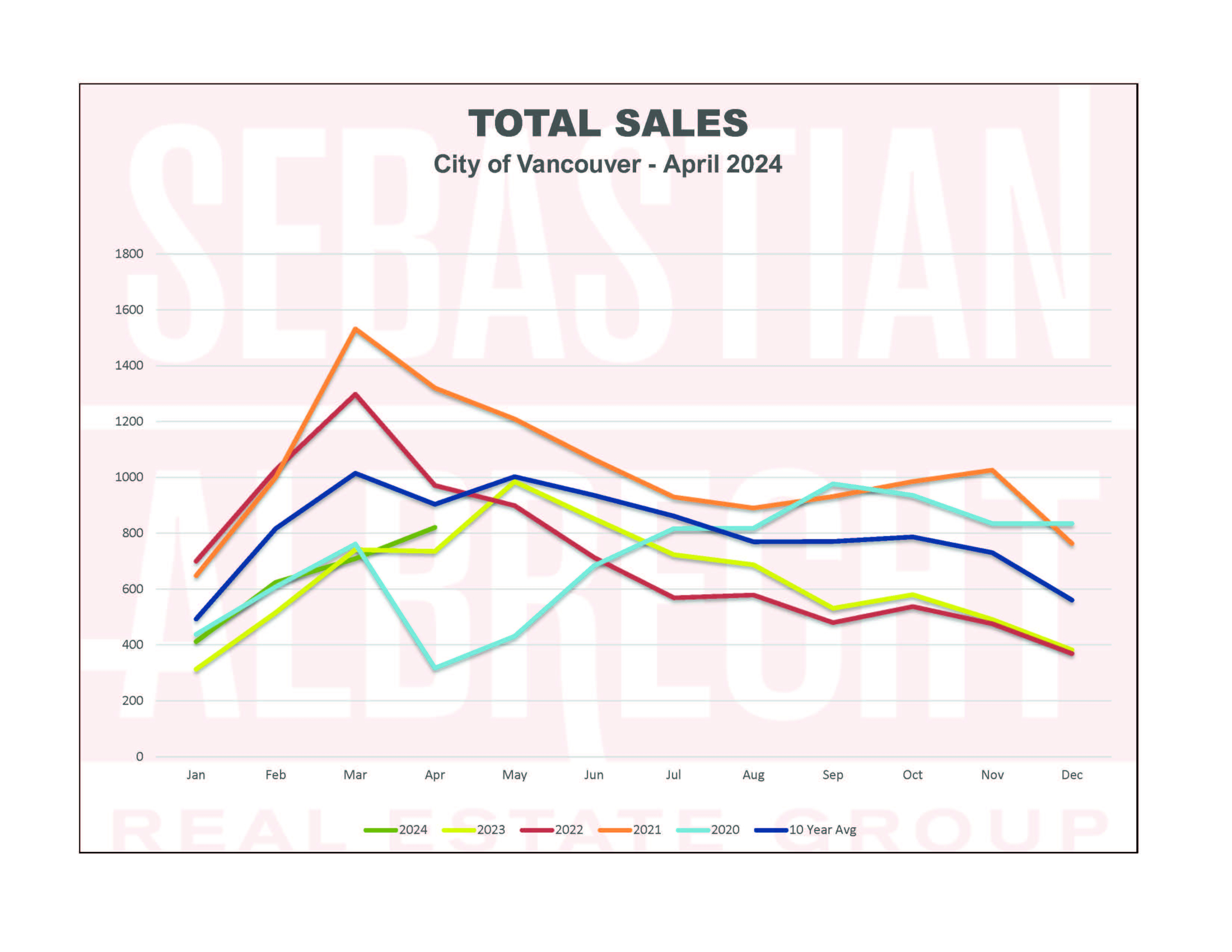

Sales jumped to 821 (+15.8% month-to-month and +11.7% year-over-year). This is down just -9.1% from the 10-year average...the closest we've been to the 10-year average in Sales since June of last year (when we last had a stronger market).

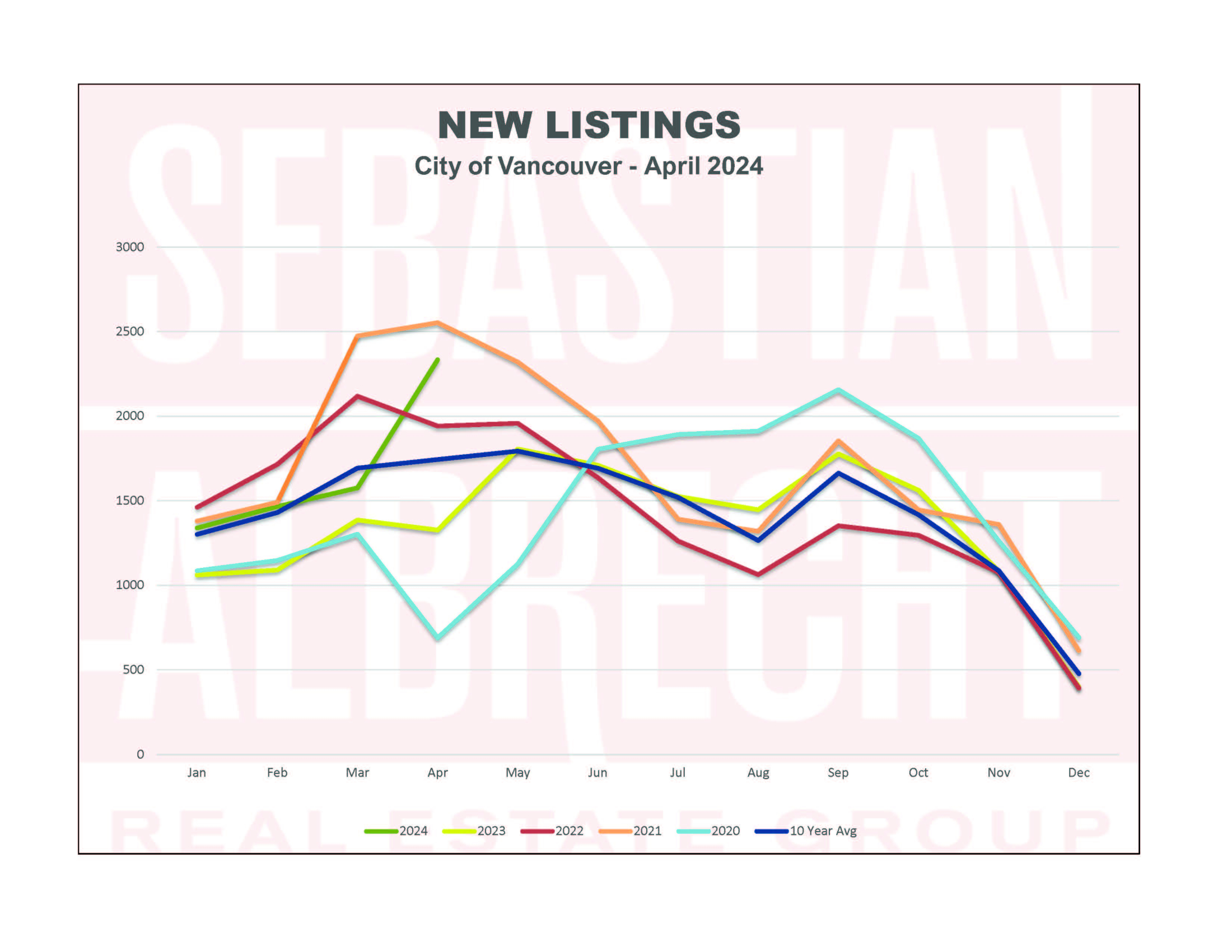

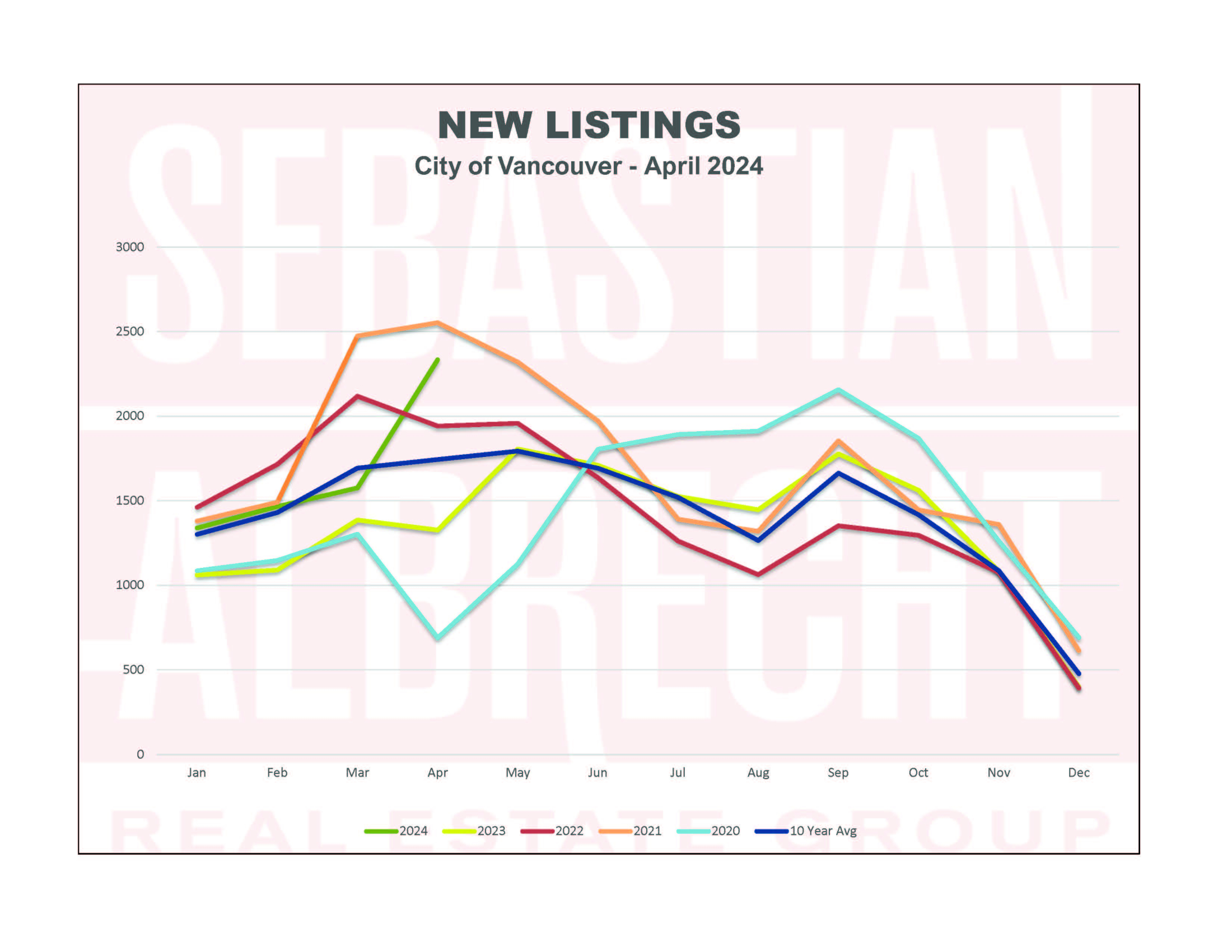

New Listings are up to 2,334 a significant +33.9% over the 10-year average (see below for why I think we are seeing this sudden bump in inventory levels) and Total Active Listings are 4,014 (a +21.4% rise over the 10-year average).

Why are we seeing inventory rise right now? I believe that there are three reasons:

1. Typical Spring activity. As mentioned earlier, we usually see inventory levels rise every month from the beginning of the year. While peak sales occur in the Spring months, inventory usually continues to build until the early summer (July) and slowly declines into the end of the year.

2. The impact of Airbnb restrictions that were implemented at the beginning of May. Many investors that owned properties exclusively for Airbnb purposes now find themselves on the wrong side of the law (and more significantly, enforcement) and they are looking to correct that...if they are choosing not to convert to long-term rentals (this time of year is also a harder time to find tenants as the school year comes to an end) then they are putting those properties on the market.

3. New capital gains rules - Those with significant capital gains are motivated to sell their property prior to the end of June. This is also contributing to a bump in listings.

All that being said, I'm finding that buyers are still struggling to find properties to buy. Yes, there is more over all inventory but good quality, well-priced homes in desirable areas are very much at a premium...and buyers continue to be frustrated that they can't find what they want on the market.

So long as interest rates don't rise, I believe that these heightened inventory levels are temporary. Based on seasonal patterns they'll likely continue to rise into the tail end of the summer...but my sense is that there is immense demand that will swallow this inventory up and only more quickly as interest rates ease through the end of the year.

However, this is actually not the case in Vancouver. While our inventory levels have risen sharply since the beginning of the year (from a low of 3,083 to a high of 4,014) this is a fairly typical pattern for the spring.

We've actually seen this level of inventory multiple times over the last four years...in the fall of last year, through the summer of 2021 and very nearly (not quite) in June 2022.

Sales jumped to 821 (+15.8% month-to-month and +11.7% year-over-year). This is down just -9.1% from the 10-year average...the closest we've been to the 10-year average in Sales since June of last year (when we last had a stronger market).

New Listings are up to 2,334 a significant +33.9% over the 10-year average (see below for why I think we are seeing this sudden bump in inventory levels) and Total Active Listings are 4,014 (a +21.4% rise over the 10-year average).

Why are we seeing inventory rise right now? I believe that there are three reasons:

1. Typical Spring activity. As mentioned earlier, we usually see inventory levels rise every month from the beginning of the year. While peak sales occur in the Spring months, inventory usually continues to build until the early summer (July) and slowly declines into the end of the year.

2. The impact of Airbnb restrictions that were implemented at the beginning of May. Many investors that owned properties exclusively for Airbnb purposes now find themselves on the wrong side of the law (and more significantly, enforcement) and they are looking to correct that...if they are choosing not to convert to long-term rentals (this time of year is also a harder time to find tenants as the school year comes to an end) then they are putting those properties on the market.

3. New capital gains rules - Those with significant capital gains are motivated to sell their property prior to the end of June. This is also contributing to a bump in listings.

All that being said, I'm finding that buyers are still struggling to find properties to buy. Yes, there is more over all inventory but good quality, well-priced homes in desirable areas are very much at a premium...and buyers continue to be frustrated that they can't find what they want on the market.

So long as interest rates don't rise, I believe that these heightened inventory levels are temporary. Based on seasonal patterns they'll likely continue to rise into the tail end of the summer...but my sense is that there is immense demand that will swallow this inventory up and only more quickly as interest rates ease through the end of the year.

Comments:

Post Your Comment: